From CISO to the Board: Cyber Accountability Is Here

Table of Content

- The CISO’s Expanding Responsibilities

- Why Boards Need CISOs More Than Ever

- The Shift from Reporting to Decision-Making Power

- Skills Boards Expect from CISOs to Serve as Directors

- Barriers CISOs Face in Securing Board Roles

- The Importance of Mentorship, Networking, and Executive Development

- What Organizations Should Do Now

- Conclusion.

- FAQs

As the CISO role expands in 2025, leaders are under mounting pressure to embed cyber accountability into governance while proving they can contribute beyond technical oversight. This blog outlines how CISOs are redefining themselves as strategic directors, shaping boardroom discussions on risk, value, and resilience.

- From Defender to Risk Leader: CISOs must shift from technical reporting to influencing enterprise risk frameworks, M&A due diligence, and third-party oversight—framing cyber as a financial and reputational driver.

- Making Accountability Part of Governance: Boards must institutionalize cyber oversight through committees, succession planning, and KPIs. CISOs who link resilience directly to shareholder value help embed accountability as a core principle.

- Preparing Leaders, Not Just Systems: Organizations should broaden CISOs’ exposure to finance, HR, and operations, preparing them to act as cross-functional leaders and credible voices in strategic continuity.

Cybersecurity is no longer just an IT concern. It has become an issue of enterprise risk, board accountability, and strategic oversight. The shift is being driven by an unmistakable combination of forces: intensifying regulatory pressure, heightened investor scrutiny, and the measurable financial impact of breaches.

The SEC cybersecurity disclosure rules now hold boards directly accountable for how they govern cyber risk management. In Europe, directives such as NIS2 impose strict obligations on directors to demonstrate effective cybersecurity oversight. For institutional investors and private equity, cyber resilience is increasingly weighted alongside financial metrics when assessing organizational value.

At the same time, cyber incidents have grown in both frequency and cost. Ransomware, supply chain exposures, and identity-driven attacks can drain millions in direct response while eroding long-term shareholder trust. This has placed cyber risk on the same level of scrutiny as capital allocation, regulatory compliance, and talent strategy.

The role of the Chief Information Security Officer (CISO) has therefore shifted dramatically. While CISO roles and responsibilities once centered on defending networks and systems, today’s mandate extends to safeguarding reputation, shareholder confidence, and regulatory standing. Boards now expect CISOs to articulate risk in business terms, influence enterprise strategy, and in many cases, sit alongside directors in governance discussions.

With this blog we aim to examine why the boardroom has become the next frontier for CISOs, what accountability means in practice, and how organizations must respond to align leadership with the rising stakes of cybersecurity governance.

The CISO’s Expanding Responsibilities

The position of Chief Information Security Officer has shifted from a technical protector to a guardian of enterprise-wide trust. Historically, CISOs were measured by how well they managed firewalls, intrusion detection, and system defense. Today, boards and regulators are assessing them on how effectively they safeguard shareholder value and organizational continuity.

Growing Expectation for CISOs To Align with Enterprise-wide Business Strategy

CISOs are now expected to translate cyber risk management into terms that align directly with revenue, capital allocation, and competitive positioning. Their influence extends to corporate growth initiatives, such as mergers and acquisitions, where vulnerabilities in a target company’s infrastructure can significantly impact valuation. Boards expect the CISO to bring early visibility into these risks and quantify their potential impact in business terms.

In private equity and venture-backed organizations, the expectation is even sharper. Investors want assurance that cyber resilience is embedded in growth strategies from the start. This requires CISOs to build fluency in strategic planning, financial modeling, and operational risk analysis, positioning them as active contributors to long-term value creation.

The Demand for Broader Business Acumen, Communication with Non-technical Stakeholders, and Risk Fluency

Technical expertise is no longer sufficient. Directors expect CISOs to demonstrate CISO skills that extend well beyond security architecture. Effective communication is paramount: a CISO must be able to present cyber risk to a board that may not have a technical background. This means framing threats not as technical flaws but as enterprise risks that could affect brand equity, customer confidence, and regulatory compliance.

Risk fluency has become a defining trait. Boards want CISOs who can evaluate not only the likelihood of an incident but also its financial, operational, and reputational impact. This requires the ability to align cybersecurity oversight with corporate governance principles, presenting metrics and analysis that inform decision-making at the highest level.

In this environment, the modern CISO is no longer confined to reporting security outcomes. They are shaping governance frameworks, influencing boardroom priorities, and integrating cyber accountability into the broader architecture of corporate leadership.

Why Boards Need CISOs More Than Ever

The board’s role has expanded to include direct accountability for cyber resilience. Security is no longer a departmental responsibility; it is now considered a central pillar of corporate governance. This shift is being driven by regulatory developments, investor priorities, and the sheer financial impact of breaches.

Rising Accountability for Cyber Resilience at the Board level

Directors are now judged not only on financial stewardship but also on how they oversee risk management in all its forms, including cyber. Investors, regulators, and customers increasingly expect boards to treat cybersecurity governance as part of their fiduciary duty. When a breach occurs, the question is no longer just how the incident happened but whether directors provided adequate oversight. This accountability requires boards to have access to security leaders who can provide them with clear, actionable insight.

Regulatory Pressures Placing Responsibility on Directors

The SEC cybersecurity disclosure rules have introduced a new layer of transparency. Public companies must now disclose material cyber incidents within strict timelines and detail how cyber risk management is integrated into board oversight. In Europe, the NIS2 directive imposes legal liability on directors for failing to supervise cyber resilience adequately. Both frameworks mark a turning point: directors are personally accountable for the governance of cyber risk.

These regulatory shifts underscore a critical reality: boards cannot delegate cybersecurity oversight. They must demonstrate that cyber risk governance is embedded in their decision-making, and this requires informed guidance from leaders who understand both technology and enterprise risk.

How Boards are now Expected to Treat Cybersecurity

Cyber incidents directly affect market value, brand credibility, and customer confidence. Shareholders increasingly question whether boards have taken sufficient action to prevent breaches and mitigate exposure. Insurers are also adjusting coverage, demanding higher standards of governance before underwriting cyber policies.

Boards that treat cybersecurity oversight as a core responsibility position themselves to protect long-term enterprise value. Those that do not risk financial penalties, reputational damage, and diminished investor confidence. In this climate, CISOs bring a perspective that no other executive can provide. They are not just technologists; they are stewards of organizational trust and guardians of enterprise resilience.

The Shift from Reporting to Decision-Making Power

For many years, CISOs attended board meetings primarily as presenters. Their role was to brief directors on cyber threats, compliance status, and technical metrics. Today, that approach is no longer sufficient. Boards are demanding not only visibility but also strategic input, and CISOs are stepping into a position where their perspective shapes governance outcomes.

How CISOs Shape Risk, M&A, and Vendor Decisions

Cybersecurity has become deeply intertwined with enterprise risk. Directors are asking CISOs to move beyond after-the-fact reporting and actively shape corporate risk frameworks. This includes influencing how the organization assesses vendor dependencies, supply chain exposures, and operational resilience.

Mergers and acquisitions present another critical area. Due diligence now requires a detailed review of a target company’s cybersecurity posture. Hidden vulnerabilities can alter deal value, create integration challenges, and expose the acquiring organization to regulatory liability. Boards rely on CISOs to conduct these evaluations and frame them in terms of shareholder risk.

Third-party oversight has also risen in importance. As companies outsource key functions to partners and service providers, CISOs are responsible for highlighting contractual risks, vendor security maturity, and potential gaps in accountability. Their assessments directly inform governance decisions around which partnerships are sustainable.

Why the Voice of the CISO is Critical for Strategy, not just Reporting

Boards cannot treat cyber risk as an operational metric to be reviewed quarterly. It is a constant enterprise exposure that influences investment priorities, brand trust, and regulatory posture. Without a CISO actively engaged in decision-making, boards lack the expertise to weigh cyber considerations against financial objectives.

The CISO’s role in decision-making also signals accountability to stakeholders. Regulators, investors, and insurers expect cyber resilience to be embedded in the organization’s governance structure. By granting CISOs a decision-making voice, boards demonstrate that they are meeting their obligations under cyber risk governance.

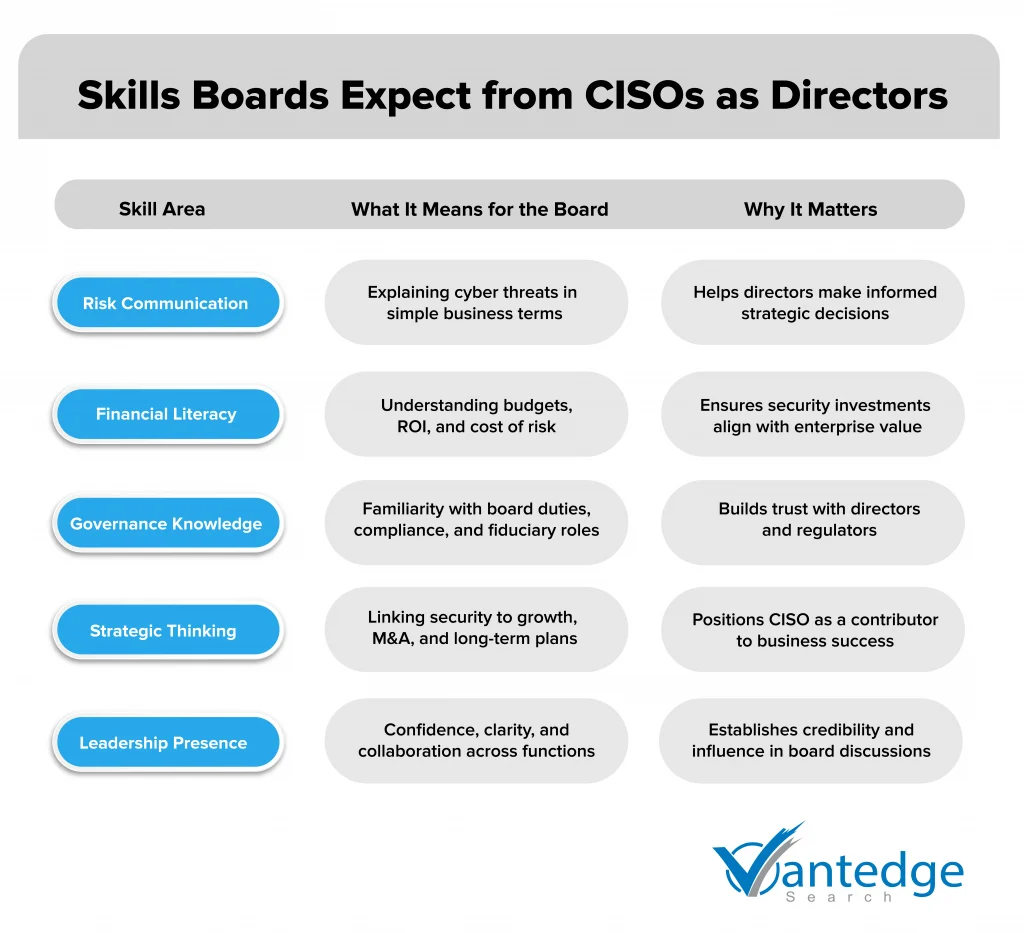

Skills Boards Expect from CISOs to Serve as Directors

As boards take on greater accountability for cyber risk, they require directors who can blend technical expertise with strategic judgment. For CISOs, this means demonstrating a skill set that goes beyond defending infrastructure and presenting compliance updates. To secure a place in governance, CISOs must show they can influence outcomes, protect enterprise value, and engage in business discussions at the same level as their peers.

Going Beyond Technical Knowledge

Directors expect CISOs to demonstrate financial literacy. Understanding how cyber investments affect margins, valuation, and capital efficiency. This involves fluency in ROI, cost of risk, and the implications of security expenditures on shareholder returns.

Equally important is grounding in governance principles. Board members must trust that CISOs understand fiduciary duties, regulatory obligations, and the frameworks that guide effective oversight. A CISO who can reference and apply governance structures signals credibility and readiness for directorship.

Strategic decision-making is the final piece. Cyber risk is now embedded in corporate growth, acquisitions, and partnerships. Boards seek CISOs who can anticipate risks that might arise from expansion, integration, or new digital offerings, and recommend proactive actions.

Ability to Communicate Risk in Business Terms

Boards do not need to know the technical intricacies of zero-day vulnerabilities. They need to know how an incident could affect customer confidence, regulatory compliance, or long-term valuation. This makes presentation skills essential for CISOs. The ability to translate technical risks into executive-ready insights and actionable recommendations is often the deciding factor between being seen as a subject matter expert or as a strategic peer.

Leadership Traits and Cross-functional Credibility that Matter in Boardroom Discussions

CISOs who seek board positions must also show leadership presence. This involves clear communication, confidence under scrutiny, and the ability to collaborate across business functions. Directors evaluate whether a candidate can hold their own among seasoned executives and contribute constructively to governance debates.

Cross-functional credibility is equally important. Boards value CISOs who have built alliances with finance, operations, legal, and HR. These relationships signal that the candidate understands how cybersecurity oversight integrates with broader enterprise performance.

Barriers CISOs Face in Securing Board Roles

While the demand for cyber accountability is unmistakable, CISOs still face structural and perceptual barriers when pursuing directorships. These challenges highlight why many qualified security leaders remain underrepresented at the board level despite their critical expertise.

Perception Gaps between Technical Expertise and Governance Readiness

A persistent misconception is that CISOs are “technical specialists” rather than strategic leaders. Boards often equate cybersecurity with IT operations and fail to recognize how CISO roles and responsibilities now extend to enterprise risk management, regulatory oversight, and financial stewardship. This perception gap can result in CISOs being overlooked in favor of candidates with more traditional governance backgrounds, even when security risk is central to the company’s stability.

Limited Board Seats

Another barrier is structural. Board seats are finite, and historically, they have been filled by individuals with backgrounds in finance, law, or general management. Technology and security experts have only recently begun to be considered essential in governance discussions. Even when boards acknowledge the importance of cyber resilience, they may hesitate to dedicate a seat to a CISO if they believe advisory access is sufficient.

The Importance of Mentorship, Networking, and Executive Development

For CISOs, securing a board position requires more than technical mastery. It demands visibility within governance circles, mentorship from seasoned directors, and targeted development in areas like cybersecurity governance and enterprise strategy. Participation in leadership networks, governance education programs, and industry boards can provide the credibility needed to overcome perception barriers.

Executive search firms also play a role here. They identify board-ready CISOs, guide them in refining their presentation of CISO skills, and advocate for their inclusion in director shortlists. Without these connections, many qualified CISOs may remain outside board pipelines despite their relevance to today’s oversight needs.

Secure Cyber Accountability With Bard-Ready Leadership.

What Organizations Should Do Now

Organizations cannot wait for regulators, investors, or insurers to dictate the terms of cyber accountability. Boards and leadership teams must act deliberately to embed cyber resilience into their governance models and talent strategies. The following steps represent practical, high-impact measures that directors should prioritize now.

- Integrate CISOs into succession planning

Boards should treat cybersecurity leadership as a permanent fixture of executive succession. Preparing CISOs for broader responsibilities signals to stakeholders that the organization views cyber oversight as core to long-term enterprise resilience. Succession planning should include structured development, exposure to financial and operational decisions, and mentorship that positions CISOs for directorship opportunities. This elevates security from a technical function to a standing element of corporate continuity.

- Build cyber expertise at the board level

Directors are accountable for cyber risk governance, yet few boards maintain formalized structures to address it. Establishing committees or appointing directors with specific cybersecurity oversight responsibility demonstrates accountability to regulators and investors. This mirrors the precedent set by audit and compensation committees, acknowledging that cyber risk demands ongoing, board-level expertise.

- Support CISOs with exposure beyond IT

For CISOs to contribute credibly to governance, they must gain insight into the broader levers of enterprise value. Boards and CEOs should deliberately involve them in discussions related to finance, human capital, supply chain, and M&A. By extending their reach into these areas, organizations prepare CISOs to act not just as defenders of systems but as leaders with cross-functional authority and strategic insight.

Taking these steps reinforces the seriousness of cyber risk management while also signaling to regulators, investors, and insurers that accountability is embedded into governance.

Conclusion

Cyber accountability is now a central measure of governance quality. Boards are expected to demonstrate oversight of cyber risk governance with the same diligence as financial reporting. The role of the CISO has evolved from a technical protector to a strategic partner, with responsibilities that directly influence enterprise resilience and shareholder value.

Boards that bring CISOs into governance discussions signal to regulators, investors, and customers that they recognize the financial and reputational stakes of cyber resilience. For CISOs, readiness for board service requires a balance of risk fluency, strategic insight, and leadership presence.

At Vantedge Search, we work discreetly with boards, CEOs, and investors to identify leaders who bring both security expertise and strategic insight to governance.

If you are considering how to strengthen your board with cyber accountability, or if you are a CISO preparing for board readiness, connect with Vantedge Search for a confidential conversation today.

FAQs

CISOs are shifting from technical custodians to strategic advisers. Their role now involves influencing board-level decisions on enterprise risk, M&A, and third-party oversight. They serve as translators of cyber risk into business implications and help the board weigh trade-offs between growth, security, and compliance.

A board-ready CISO must combine financial literacy, governance knowledge, and strategic judgment. They need to communicate risk in business terms, command leadership presence, and establish credibility across functions. Risk fluency and the ability to participate in broader corporate discussions are also essential.

The transition requires deliberate steps: gaining exposure to enterprise strategy beyond security; serving on advisory boards or committees; securing governance training; and cultivating relationships in board networks. Executive search firms can help position the CISO as a strategic candidate rather than a technical specialist.

Regulations like the SEC’s cybersecurity disclosure rules mandate public firms to report material cyber incidents and explain board oversight. In the EU, NIS2 holds directors personally responsible for inadequate cybersecurity governance. These frameworks reinforce that boards can no longer delegate accountability entirely to management.

CISOs should hone skills in risk quantification, stakeholder communication, and governance frameworks. They must master translating technical risk into financial and reputational terms. Building cross-functional relationships and gaining visibility in strategic initiatives further solidify their readiness for board engagement.

Leave a Reply