CEO Succession Crisis: The Silent Collapse of Corporate Leadership Pipelines

- Over 14% of S&P 500 CEOs exited in Q1 2025 and nearly half of their replacements were external, exposing weak internal benches and elevating succession into a board-level crisis.

- The blog explains how boards, investors, and talent leaders can rebuild continuity by diagnosing root causes, evaluating successor readiness, and embedding succession planning into talent strategies and being prepared with emergency succession plans.

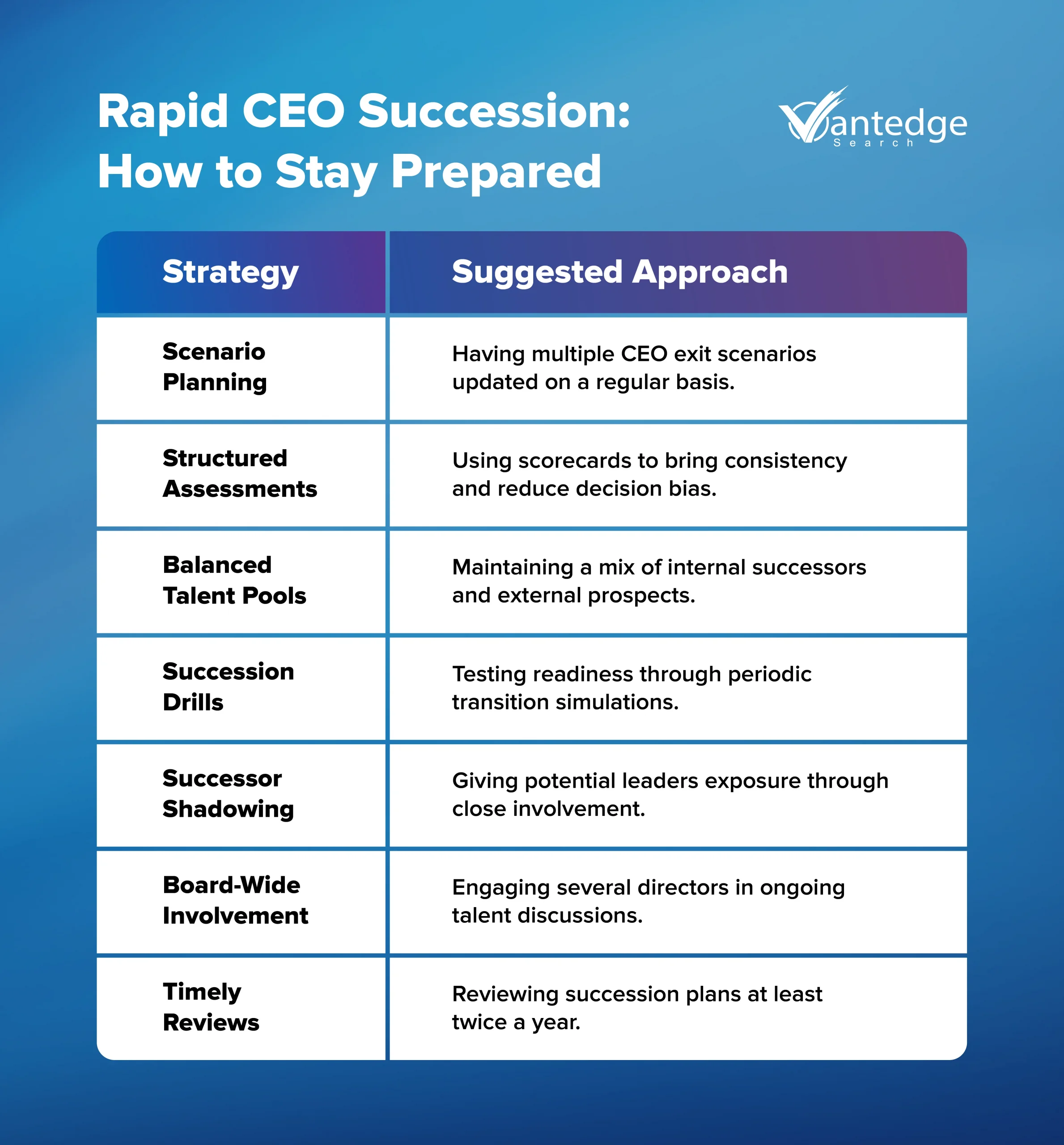

- A practical framework is presented: scenario-based planning, structured bias-aware assessments, succession drills, parallel internal/external talent tracking, and defined development paths for high-potential leaders.

- Risks of defaulting to external or returning CEOs and of stagnant plans are highlighted, with emphasis on keeping successors visible and stress-tested to prevent destabilizing leadership change.

A sudden CEO exit and the absence of a succession plan is nothing short of a nightmare for enterprises. The stakes are especially high when it is a publicly traded company or highly visible in the media, in which case, media leaks and scrutiny add to the urgency of such scenarios. That’s when executive hiring teams need to go into hyperdrive mode to create emergency succession plans

Over the first quarter of 2025, more than 14% of CEOs at S&P 500 companies exited their positions, a surge that represents the highest turnover in decades. Nearly 44% of their replacements were drawn from outside the organization, signaling a growing erosion of internal readiness.

These numbers expose a quiet but urgent leadership crisis: many organizations lack a resilient pipeline of internal successor candidates. Rising rates of job‑hopping among high‑potential talent, paired with leaner middle management structures, have thinned the bench. The consequence is a board‑level emergency when unexpected executive transitions occur.

This blog looks at the root causes behind this crisis, the risks posed by reactive executive hiring, and outlines strategic, forward‑looking practices boards can adopt to anticipate CEO succession needs.

Understanding the CEO Succession Emergency

CEO turnover trend is nothing new, but the velocity, timing, and context of exits in 2025 have shifted the conversation from routine transitions to a systemic fault line.

According to Challenger, Gray & Christmas, CEO departures across U.S. companies reached 646 in Q1 2025, up 43% from the same period in 2024. These are not simply cases of retirement at the end of long tenures. A large proportion of exits are happening mid-tenure, driven by performance pressures, personal burnout, and shifting boardroom expectations.

What’s Driving the Surge?

Burnout has become a defining feature of C-suite leadership in the post-2020 cycle. The extended weight of leading through COVID-19, digital transformation mandates, geopolitical tension, and now AI-led workforce shifts has left many CEOs exhausted and unwilling to extend their tenures. For those already at retirement age, this pressure has only accelerated departure decisions.

Generational shifts in leadership style and expectations are also at play. Boards are seeking executives who align with a different style of leadership, those who can guide organizations through complexity with adaptability and stakeholder awareness. Some legacy CEOs are being nudged out not due to failure, but due to misalignment with the board’s revised vision.

Economic headwinds add to the stress. With interest rates remaining volatile and global supply chains still rebalancing, many boards are opting for decisive leadership changes in hopes of a performance reset. This further fuels the demand for replacements, many of whom are expected to “hit the ground running”, an expectation that leaves little time for grooming internal candidates.

The Boomerang CEO Trend, and Its Risks

In the absence of ready successors, many companies have turned to familiar faces. In 2024 and early 2025, 22 companies in the S&P 1500 reappointed former CEOs, making “boomerang CEOs” more common than at any time in the past decade. While familiar leadership may comfort boards in moments of instability, research from the Financial Times reveals that boomerang CEOs tend to deliver 7.4% lower total shareholder returns in their second terms, compared to a 5.5% outperformance during their original tenures.

In short, boards are making high-stakes leadership decisions with fewer internal options, under more pressure, and with higher performance expectations than ever before. This is not a transitory challenge, it’s a systemic leadership vulnerability.

Why Internal Pipelines Are Drying Up

The sharp rise in external CEO hires is not a signal of expanded opportunity. It’s an indictment of how organizations have allowed their internal leadership pipelines to wither. Despite repeated discussion in boardrooms about “bench strength,” many companies have neglected to invest in the kind of long-range development required to produce CEO-ready leaders from within. When internal readiness is lacking, some boards lean on a CEO recruiting firm or engage CEO recruitment agencies as a fallback, which can create false confidence if internal development isn’t progressing in parallel.

The Job-Hopping Culture

One of the most consistent disruptions to internal succession is retention. High-potential leaders in their 30s and 40s are no longer motivated by the promise of eventual promotion. Loyalty to one company over a long stretch of time, once a hallmark of executive growth, has been replaced by a pragmatic approach to career progression. Candidates are often more likely to switch firms for immediate advancement than wait in the wings for an uncertain promotion.

This has created a structural gap: the very individuals who would, under previous models, have been groomed for the top role now rotate out before long-term mentorship and development efforts bear fruit. The board’s presumed “next-in-line” often no longer exists by the time the seat opens.

Flattened Structures, Fewer Steppingstones

Over the past decade, companies have streamlined leadership layers to increase agility and reduce costs. While effective in cutting overhead, this shift has significantly reduced the number of intermediate executive roles, those crucial steppingstones that give leaders experience with board governance, cross-functional accountability, and crisis management.

In many firms, the traditional COO, division president, or EVP roles have been either consolidated or eliminated entirely. As a result, promising talent finds itself stuck below the top tier, lacking the complexity and breadth of experience required to be considered “CEO-ready.”

Talent Development Has Been Underfunded, and Underprioritized

Leadership development is often among the first areas to face budget pressure when firms look to contain costs. And when it is funded, it is frequently fragmented, reactive, or designed around short-term performance needs rather than long-term succession.

Rather than nurturing leadership potential over five to ten years, organizations have defaulted to annual review cycles and generic high-potential programs. This has created a shallow pool of candidates with operational expertise but limited strategic readiness.

Moreover, few boards require the CEO to report progress on succession planning in a structured way. Without board-level accountability, talent pipeline health often drifts into background noise, which is important in theory but neglected in practice.

The net result: when a CEO exit becomes imminent, companies are left unprepared. They scramble, not because they didn’t see it coming, but because the leadership layer beneath was never cultivated to rise.

The Hidden Risks of Weak Succession Planning

When a CEO departure occurs without a clear successor, the effects ripple far beyond the executive floor. The absence of a credible, timely transition plan can erode confidence, shake investor trust, and jeopardize the execution of long-term strategy. Yet many boards continue to treat succession as a compliance topic—something to check off rather than embed as a central pillar of corporate continuity.

The Cost of Sudden CEO Exits

Leadership transitions made in haste often invite instability. A poorly communicated CEO exit strategy or lack of clarity around timing can deepen market reaction and prolong uncertainty. Internally, senior teams face ambiguity around direction, and decision-making slows. Externally, stakeholders, particularly investors, perceive risk. Markets are quick to punish uncertainty at the top, especially in publicly traded firms where CEO identity is strongly tied to brand perception and investor confidence.

A study published in the Harvard Business Review found that companies with no named successor at the time of a CEO exit experience declines in stock price in the days following the announcement. This reflects not just concern over the outgoing leader, but a judgment on the board’s preparedness.

For private equity-backed firms or late-stage ventures, the risks are magnified. Without succession clarity, financing rounds, M&A talks, or IPO timelines can stall. Key partners—both internal and external, may pause, renegotiate, or exit.

Underestimating the Board’s Exposure

While operational leaders may carry the day-to-day weight of performance, it is the board that holds ultimate accountability for CEO continuity. Weak succession planning is often treated as a shared blind spot. In truth, it is a direct failure of board governance.

The oversight risk grows when boards lack visibility into internal talent strength or accept vague assurances from the CEO that successors are “in development.” In some cases, the outgoing CEO may even discourage transparent succession discussions for fear of being edged out too early or losing authority.

Regulators and shareholders are increasingly scrutinizing these gaps. Proxy advisors and activist investors now assess succession planning disclosures as a proxy for board diligence. Inadequate succession strategies can trigger reputational risk and even shareholder revolts, particularly when sudden exits leave boards visibly unprepared.

Reputational and Strategic Drift

The longer a company operates without a defined leadership future, the more likely strategic drift sets in. Initiatives stall, culture erodes, and organizational energy fragments. It is not merely about continuity of operations, but continuity of vision. The absence of succession clarity can signal to the market that the organization is reactive rather than deliberate, a costly perception in high-stakes industries like financial services, technology, and healthcare.

Succession planning, then, is not about predicting the date of a departure. It’s about reducing exposure, both reputational and operational, by ensuring that leadership continuity is always in a state of readiness.

Building Stronger Internal Leadership Pipelines

The most resilient organizations don’t wait for the boardroom to demand a successor—they cultivate one constantly. A credible internal pipeline isn’t a byproduct of performance management or promotion cycles. It’s the result of intentional, long-horizon planning tied directly to the company’s strategic direction.

Rethinking How High-Potential Talent Is Identified

Traditional methods of identifying future CEOs have relied heavily on current performance and visible leadership traits. However, delivering results in a business unit does not automatically translate to enterprise readiness. Today, boards and CHROs must examine deeper markers, such as an individual’s ability to operate in ambiguity, align cross-functional interests, influence without authority, and absorb pressure without emotional volatility.

Organizations that excel in internal succession don’t just ask, “Who’s performing today?” They ask, “Who can carry the weight of the future, both in style and substance?”

This requires a shift from manager-driven nominations to more rigorous assessments. Behavioral simulations, structured 360-degree reviews, and scenario-based evaluations help separate charisma from capability. These tools also enable boards to move beyond surface-level “mini-me” selections that too often reflect existing leadership biases rather than future-fit potential.

Building Career Architecture, Not Just Development Programs

Too often, companies treat talent development as a set of episodic learning experiences, a leadership program here, a coaching session there. But what high-potential executives need is trajectory, not training. Boards should press management teams to construct visible, credible pathways that allow promising leaders to accumulate cross-functional experience, P&L ownership, and board exposure.

This is especially critical for underrepresented talent. Women and executives from diverse backgrounds are statistically less likely to be sponsored into stretch roles or gain visibility in front of the board. If companies rely on “readiness” signals that are skewed by access, they inadvertently narrow the pipeline.

Rotational assignments, international postings, crisis leadership exposure, and interim responsibilities are all proven ways to prepare executives for the top role. But these must be deliberately planned, not left to chance or favoritism.

Retention Through Opportunity, Not Just Incentives

Keeping top talent engaged isn’t just a matter of pay. Many high-potential leaders leave not for more money, but for more meaning. Boards should ask: Are our future leaders seeing a path upward? Are they connected to strategic decisions? Are they mentored by current executives, or isolated by hierarchy?

Pairing succession candidates with board mentors, involving them in enterprise-level projects, and communicating their value explicitly are strategies that increase retention and buy-in.

Internal succession is rarely the fastest path, but it is often the most stable and aligned. It signals continuity, preserves institutional knowledge, and builds trust among stakeholders. But it only works if the organization is building deliberately, long before the need arises.

Strategies for Rapid Succession Preparedness

Even the best pipelines require a contingency plan. In today’s environment, boards cannot afford to treat CEO succession as a linear timeline. Sudden health events, geopolitical volatility, shareholder pressures, or private equity interventions can compress a succession window from years to weeks. Preparedness must be agile, but grounded in structure.

Scenario Planning: Thinking in “What Ifs”

An emergency succession plan for CEO is a foundational scenario; boards that are best positioned for continuity maintain multiple succession scenarios—not just one ideal candidate. This includes preparing for immediate transitions (unplanned exits), near-term changes (1–2 years), and long-term development timelines (3–5 years). Each should be mapped to specific individuals or profiles and refreshed quarterly.

These scenarios should include:

- Emergency internal successors (interim readiness)

- External executive search targets

- Alignment with business continuity priorities (e.g., transformation, turnaround, M&A)

When scenario planning is absent, companies are often forced to rely on external recruiters under severe time pressure—raising cost, compromising fit, and signaling instability.

Secure your CEO succession strategy today with Vantedge Search

Structured Assessments: Removing Guesswork

Succession evaluations cannot rely on informal recommendations or gut feeling. Boards should work with CHROs and external advisors to implement structured frameworks that apply consistent, bias-reducing criteria to candidate evaluations.

Scorecards that incorporate competencies tied to strategic priorities, not just leadership behaviors, are essential. For example, a company facing capital restructuring and global expansion will need different leadership capabilities than one focused on operational stabilization.

These scorecards should be applied across internal candidates and external search targets to compare with clarity. This also helps mitigate the all-too-common overvaluation of external experience over internal alignment.

Balanced Talent Pools: Looking In and Out

While promoting from within is often ideal, over-indexing on internal candidates can blind organizations to strategic options. The most disciplined boards maintain a bench of internal successors in parallel with an active awareness of external talent. This does not mean running a continuous search, it means having up-to-date intelligence on market-ready leaders who could step in if needed.

Maintaining this dual track provides options without panic. It also allows the board to benchmark internal talent against real external comparable qualities, rather than hypothetical ideals.

Succession Drills: Testing Readiness Before It’s Real

Boards should rehearse leadership transitions just as companies test business continuity plans. These simulations reveal practical gaps: Who communicates first? Is the interim CEO truly credible? Do financial stakeholders have a direct line to leadership?

A well-run succession drill also helps reinforce urgency across the organization. It signals that continuity isn’t theory, it’s preparedness.

Successor Shadowing and Visibility

Bringing potential successors into executive decision-making forums, such as board meetings, earnings prep, or investor sessions, helps build readiness and credibility. This also prepares the organization culturally: internal stakeholders begin to recognize future leaders before announcements are made.

Shadowing should not be ceremonial. It should reflect real strategic engagement and prepare successors to inherit the full complexity of the CEO mandate, not just its visibility.

Board-Wide Involvement and Accountability

Succession is not a task to be outsourced to the CEO or CHRO. It requires the active participation of a cross-section of directors who can bring different perspectives and check against groupthink.

Regular succession reviews should be built into board agendas, and outcomes tracked—not just in names but in progress: has the candidate grown? Do gaps remain? Has retention risk increased?

By distributing ownership, boards reduce reliance on any one member’s judgment and institutionalize the process.

Time-Bound Reviews: Keeping Plans Current

Succession strategies should be reviewed formally every six to nine months. In volatile sectors, it should be done even more often. This rhythm ensures that changes in business strategy, performance trajectories, or executive availability are accounted for in real time. A succession plan that hasn’t been discussed in over a year is, in effect, a liability. Working on emergency succession plans becomes more challenging in the absence of an established SOP to fall back on. Instead of customizing a plan for a specific scenario, hiring teams must work on a plan from scratch that may or may not be future-proof.

Conclusion

CEO succession is a point of governance vulnerability that corporations must plan for with great precision and proactiveness. Recent turnover patterns and the growing dependence on external replacements expose organizations to disruption, strategic drift, and value erosion when leadership changes occur with little warning. Continuity at the top rests on visible, credible successors beneath it, individuals who have been assessed, developed, and tested against realistic scenarios before the gap opens.

Boards, CEOs, and talent leaders must share responsibility: routine reviews of succession plans, structured readiness assessments, and simulated transitions need to be part of the governance rhythm. Internal candidates should have defined pathways and exposure, while investors and ownership groups should benchmark internal strength against external options to avoid false confidence. The window to prepare is finite; a dormant plan becomes a liability, and a weak pipeline forces reactive decisions with higher cost and misalignment. Building and validating the bench now makes future leadership change manageable instead of destabilizing.

Partner with Vantedge Search to future-proof your CEO bench, before the boardroom clock starts ticking.

FAQs

A convergence of rising mid-tenure exits driven by burnout, board impatience, shifting expectations, and economic pressure has accelerated turnover, while internal readiness has weakened because high-potential leaders are leaving, middle layers have thinned, and long-term talent development has been deprioritized. Boards frequently lack clear visibility or structured oversight on successor readiness.

External and returning CEOs are used when internal options appear insufficient, offering speed or familiarity, but returning leaders often underperform their prior tenures and external hires carry integration and alignment risk; reliance on these choices without parallel internal cultivation signals reactive governance and can erode long-term value.

Readiness should be assessed through structured, multi-dimensional evaluations—behavioral simulations, consistent scorecards tied to strategic needs, scenario stress tests, multi-source feedback, and sustained exposure in strategic forums—combined with cross-director calibration to surface blind spots.

Effective preparedness layers emergency, near-term, and development scenarios; rehearses transitions via succession drills; maintains parallel internal and vetted external candidate pools; and refreshes plans regularly so the organization can move decisively without scrambling.

Succession plans should be revisited at least every six to nine months, more often in volatile contexts, with the board owning oversight and the CEO/CHRO supplying candid data and development execution; shared accountability prevents stagnation and reduces governance exposure.

Leave a Reply