Profit-First CIOs: Tech Leaders as Revenue Champions

- Profit-First CIOs are a board-level necessity, not a technical afterthought. Embedding profit and margin metrics alongside traditional IT KPIs secures stronger funding, enforces investment discipline, and bolsters stakeholder confidence in every digital initiative.

- Shifting the CIO’s remit from systems to sales breaks down silos. Framing each project as a revenue‑ or margin‑enhancing opportunity converts IT from cost center to strategic partner, enabling early wins and preventing underutilized platforms from draining resources.

- Deliberate planning routines build commercial rigor. Cross‑functional workshops, joint P&L forecasting, and data‑driven project ranking equip CIOs to prioritize high‑yield initiatives, anticipate budget pressures, and sustain profit momentum amid market fluctuations.

- Governance structures cement the profit-first mindset. Joint steering committees with finance and revenue, incentives tied to business IT metrics and stage‑gate funding linked to revenue milestones create a cycle where technology decisions drive growth and long‑term value.

As part of the evolving role of the CIO, investor expectations have shifted: the value of IT investments is now measured by profit contribution rather than infrastructure stability. According to Gartner’s 2025 CIO Funding Report, CIOs who present the impact of IT in terms of revenue and margin objectives achieve 60 percent higher funding levels than market peers. Yet only 48 percent of digital initiatives meet or exceed their business outcome targets. This change has placed financial fluency and commercial awareness at the core of the CIO role. System availability, while essential, no longer defines success. Instead, executive leadership assesses technology decisions by their impact on sales growth, margin expansion, and customer value.

In this blog, we will discuss how traditional IT growth strategies give way to business-focused IT metrics, highlight essential leadership skills required for CIOs under profit-first mandates, and outline the steps needed to translate IT programs into quantifiable revenue gains.

Moving Beyond Traditional IT Metrics to Profit Focus

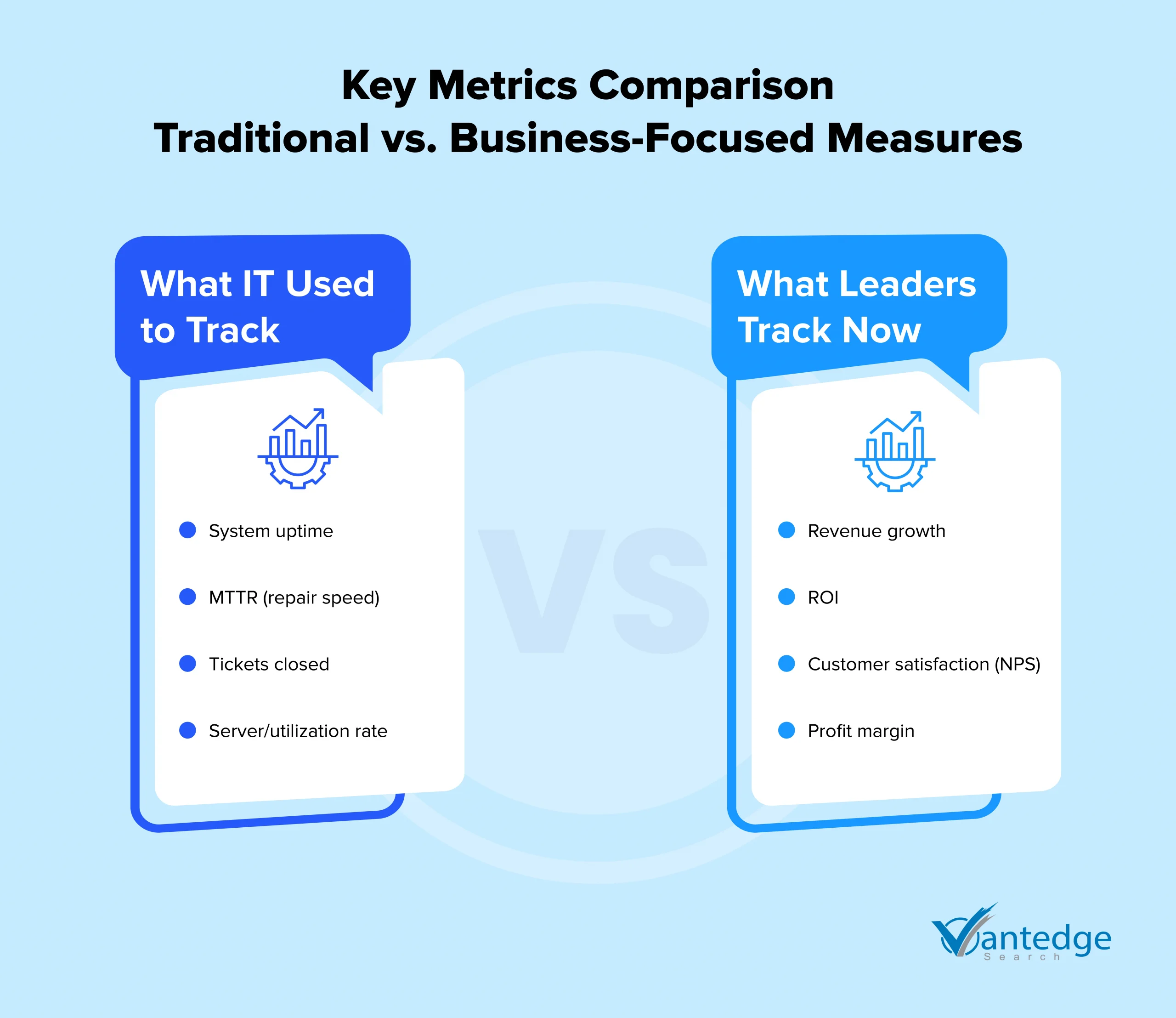

IT growth strategies have long centered on operational performance such as uptime percentages, ticket volumes, mean time to repair (MTTR), and utilization rates. These measures guaranteed infrastructure reliability and team responsiveness, but they reveal little about a project’s ability to drive revenue or improve margins. Today, boards expect CIOs to report not just on service levels, but on how technology initiatives translate into business impact. This shift from pure IT metrics to business-focused IT metrics demands a new approach to performance measurement and accountability.

Comparing old IT KPIs with new business-focused measures

When AI takes on up to a third of routine duties such as data entry, preliminary analysis, template drafting, teams can redirect their time to high-value work like strategy, relationships, and innovation. Without proactive planning, organizations risk understaffing key roles, paying steep contingency hiring premiums, and pushing back go-to-market dates. Workforce planning for AI automation arms boards with forward-looking headcount and skill forecasts, so budgets for targeted learning and redeployment are approved before disruption occurs.

From HR procedure to boardroom imperative

Historically, CIO performance hinged on indicators such as system uptime (often above 99.9%), average MTTR, and the number of tickets closed per month. While these figures ensured that critical applications remained online and support teams met their SLAs, they did not quantify how IT investments affected growth. For example, a 0.1% improvement in uptime might reduce downtime by less than an hour per year, which is more like an operational win that rarely moves the revenue needle.

In contrast, leading CIOs now report metrics that tie directly to financial outcomes:

- Revenue growth tied to IT initiatives: Tracking percentage increases in sales or bookings that result from new platforms or automation.

- Return on technology investment (ROI): Calculating net gains in profit divided by total IT spend.

- Customer satisfaction uplift (NPS change): Measuring how improvements in digital experience boost customer loyalty and drive repeat purchases.

- Profit margin contribution: Assessing incremental margin generated by IT-enabled services after accounting for both direct and indirect costs.

These business-focused IT metrics ensure that every technology project is assessed by its contribution to the P&L. By replacing traditional KPIs with measures directly linked to revenue and margin, CIOs align IT growth strategies with the company’s financial goals and provide the board with clear, actionable insights into technology’s role in driving business growth.

Reasons Behind This Change: Market Demands, Competition, and Stakeholder Expectations

Boards and executive teams now view technology as a core driver of competitive advantage rather than a back-office cost center. Clients expect seamless digital experiences and rapid product enhancements; failing to meet those standards leads directly to lost contracts or price concessions. Meanwhile, private equity and venture capital firms conduct rigorous due diligence on margin contribution before investing, pressing portfolio companies to demonstrate clear revenue attribution from IT projects.

Impact on How CIOs Are Evaluated and Rewarded

The shift to profit-first performance measures has concrete implications for executive compensation and career advancement. In many organizations, CIO bonus structures have been reconfigured to include targets for net profit contribution, customer retention rates attributable to digital channels, and time to revenue realization for new products. Base salaries remain tied to technical delivery, but the most significant variable pay components now hinge on business outcomes. As a result, CIOs who master P&L dialogue and can forecast revenue impact months in advance gain recognition as strategic partners—often positioning themselves for broader C-suite roles or board appointments.

Key Skills for a Profit-Driven CIO

A Profit-First CIO must combine technical expertise with sharp commercial instincts. The following competencies define executive leaders who guide IT growth strategies toward measurable business outcomes rather than purely operational wins.

Understanding Financials and Managing Profit and Loss

An executive with a commercial mindset reads a P&L statement as fluently as a network diagram. This means breaking technology budgets into line items and forecasting how each investment will contribute to gross and net margins. A Profit-First CIO collaborates with finance to build rolling forecasts, stress-tests scenarios for revenue impact, and uses cost accounting to allocate shared services across business units. By speaking the language of EBITDA and cash flow, the CIO gains credibility at the board level and secures funding for initiatives that directly contribute to IT-driven revenue.

Knowing the Market and Customers Well

Deep customer insight is no longer optional for technology leaders. A Profit-First CIO works with client-facing teams to analyze buying patterns, understand service-level expectations, and identify gaps that technology can fill. Whether through customer journey mapping or voice-of-customer programs, the CIO gathers data that turn operational improvements into sales opportunities. For example, a frictionless portal for renewals or a self-service analytics dashboard can directly increase customer satisfaction and lifetime value, demonstrating the link between IT growth strategies and revenue retention.

Working Closely with the CFO and Business Teams

Aligning IT investments with business goals requires a partnership mindset. Profit-First CIOs convene joint steering committees with the CFO, head of sales, and product leaders. They agree on shared KPIs such as revenue per feature, margin per customer segment—and commit to quarterly business reviews that assess both technical delivery and commercial impact. This collaboration ensures that IT budgets are not siloed and that every platform enhancement has an associated business case, fostering accountability for results rather than mere project completion.

Making Data-Based Choices to Increase Revenue

Data-driven decision-making underpins every profit-focused initiative. A Profit-First CIO establishes analytics platforms which are often powered by AI that track user behavior, adoption rates, and feature ROI. Dashboards visualize which digital services attract upsells, or which integrations shorten sales cycles. These insights guide prioritization: IT projects are ranked by projected revenue uplift and margin contribution rather than by complexity alone. By utilizing business-focused IT metrics into daily governance, the CIO ensures that technology decisions drive revenue growth and meet stakeholder expectations.

Building a Business-Oriented Approach in IT

A Profit-First CIO must recognize that incorporating revenue objectives into IT planning is no longer an afterthought but the very foundation of value creation. Shifting from pure operational oversight to a business-oriented approach requires reframing every project as an opportunity to advance the company’s commercial agenda.

Applying profit-first thinking in IT planning

In practice, the CIO leading leadership for growth convenes cross-functional workshops where financial and technical teams jointly define success criteria. Rather than approving a server refresh because of aging hardware, the conversation centers on how upgraded capacity will reduce processing costs and enable new service tiers. Profit-first thinking demands that each roadmap item carries a clear profit-and-loss statement, forecasting incremental revenue against implementation cost. Such rigor turns traditional IT growth strategies into business-focused IT metrics that resonate with boards and investors.

Matching technology projects with revenue goals

Aligning technology investments to revenue targets requires CIOs driving business growth to map every initiative back to strategic sales outcomes. For instance, an API integration is not simply a technical task; it becomes a channel for upselling existing customers and tapping new market segments. By establishing KPIs such as deal velocity improvement or service attach rate uplift, IT leaders convert abstract development efforts into tangible contributions to the top line.

Finding a balance between innovation and cost control

A truly distinguished CIO balances the allure of breakthrough innovation with the discipline of margin management. Experimentation budgets must be ring-fenced and measured against control groups, ensuring that pilots earn their place in the production environment by demonstrating profit potential. This dual focus on creative ideation and rigorous financial analysis safeguards the P&L from runaway costs while keeping the door open for unexpected revenue opportunities.

Schedule your Profit‑First readiness review today

Forming teams focused on revenue results

Finally, building a profit-first culture means organizing IT teams around commercial outcomes. Dedicated pods, comprising developers, business analysts, and finance liaisons, own specific revenue streams or customer segments. These pods operate with end-to-end accountability: from ideation through deployment to ongoing margin analysis. When teams are structured around clear revenue objectives, every sprint delivers not only code, but also data on customer value and profitability. Through this organizational design, CIOs driving business growth ensure that technology becomes a persistent engine for revenue generation rather than a cost center.

Actionable Steps to Improve Profitability

Translating IT growth strategies into measurable business results requires targeted actions. The following approaches detail how a Profit-First CIO can turn technology investments into clear revenue gains and margin improvements.

Using analytics and AI to identify new income opportunities

Advanced analytics and AI models reveal hidden patterns in customer behavior and service usage. A Profit-First CIO must implement predictive algorithms to anticipate upsell and cross-sell opportunities, segmenting clients by profitability potential. For example, machine-learning models can flag high-value accounts at risk of churn, prompting proactive outreach that preserves recurring revenue. Similarly, AI-driven recommendations embedded in client portals can increase average deal size by up to 15 percent, according to McKinsey’s research on personalization.

Updating core systems to lower costs

Legacy infrastructure often drags down profit margins through high maintenance and energy expenses. It is important for a Profit-First CIO to lead a phased migration to cloud and containerized platforms, replacing underutilized servers with on-demand resources. This shift will typically reduce total cost of ownership over a period of time while improving scalability for revenue-generating applications. Key to success is establishing clear business-case metrics up front, projecting both the savings in operational spend and the revenue upside from faster time to market.

Developing pricing strategies for tech services

Profit margins depend as much on pricing models as they do on cost control. In partnership with finance and commercial teams, the Profit-First CIO must evaluate value-based pricing for services such as managed infrastructure or analytics-as-a-service. Rather than simple time-and-materials rates, the CIO should propose tiered subscription plans with performance-linked fees like tying part of the charge to uptime guarantees or outcome metrics like transaction volumes.

Offering subscription or results-based service options

Shifting from one-time projects to subscription or results-based engagements creates predictable revenue streams. A CIO driving business growth must structure offerings where clients pay for outcomes such as per-user fees for a custom dashboard or success-based fees tied to efficiency gains. This model will help spread revenue recognition over multiple quarters and deepen customer relationships, increasing lifetime value.

Common Obstacles and How to Address Them

Despite the clear advantages of a profit-first approach, CIOs frequently encounter three core challenges that can derail progress unless addressed with executive-level rigor.

Changing Company Culture and Attitudes

Shifting from “keep the lights on” to “drive revenue” demands more than new KPIs; it requires a fundamental change in mindset across IT and the broader organization. Resistance often surfaces when teams perceive profit-focused metrics as a threat to technical excellence or as extra work. To overcome this, the CIO must articulate a coherent narrative linking each technology initiative to client value and company performance. Regular all-hands briefings, cross-team workshops and visible sponsorship from the CEO and CFO reinforce the expectation that business-focused IT metrics are non-negotiable.

Handling Old Systems and Past Investments

Legacy platforms and sunk-cost biases can stall profit-driven IT growth strategies. Organizations often cling to on-premises systems simply because they have already been funded, even when those systems no longer support new revenue models. A Profit-First CIO tackles this by conducting a rigorous “value-at-risk” analysis that compares ongoing maintenance costs against the projected margin uplift from modern alternatives. This analysis should be presented alongside real data such as support tickets, energy bills and customer feedback, to build an irrefutable business case. Where wholesale replacement is impractical, hybrid approaches that bolt on cloud services or containerize key workloads can deliver incremental profit improvements without abandoning prior investments.

Balancing Short-Term Profits with Long-Term Projects

Executive pressure for immediate ROI can pit quick wins against strategic initiatives with longer horizons, such as infrastructure modernization or data-platform consolidation. To navigate this tension, CIOs must craft a portfolio view that allocates a defined percentage of the IT budget to “fast-payback” projects and another to “strategic bets.” This balance is best managed through stage-gate financing: early-stage projects are funded with smaller allocations and must meet predefined revenue or margin milestones before receiving full investment. Such a framework preserves resources for transformational work while satisfying stakeholder demands for early profit reporting.

Measuring Profit-First Success for CIOs

Traditional uptime and ticket metrics have given way to measures that directly tie IT investment to financial outcomes. By defining and tracking the right metrics, CIOs demonstrate their strategic impact and earn the board’s trust in their ability to drive business growth.

Revenue Generated per Dollar Spent on Technology

A straightforward ratio, that is, total incremental revenue divided by total IT expenditure, provides a clear gauge of efficiency. For example, if a new customer portal rollout costs $2 million and yields $10 million in additional bookings, the CIO has secured a 5:1 revenue-to-investment ratio. Monitoring this metric across multiple projects helps prioritize future investments, ensuring scarce resources flow to the highest-yield initiatives rather than low-impact operational work.

Profit Margins of IT-Driven Products or Services

Beyond top-line gains, profitability depends on controlling costs. CIOs calculate the gross margin contribution of each technology-enabled offering by subtracting all related implementation and operating expenses from associated revenues. A real-time dashboard that tracks margin percentage by service line, whether managed security, analytics subscriptions, or digital customer experiences, reveals which offerings deliver the best return and which require cost-optimization or repricing.

Increase in Customer Value Linked to IT Efforts

Customer lifetime value (CLTV) growth serves as a proxy for long-term business health and the quality of digital experiences. CIOs map improvements in CLTV to specific IT enhancements, such as faster onboarding, self-service analytics or personalized engagement engines, and quantify how these changes reduce churn or boost upsell rates. This measure aligns technology delivery with the commercial imperative of deepening customer relationships and securing recurring revenue streams.

Speed from Project Start to Revenue Impact

Time-to-value is a critical indicator of a CIO’s agility. Measuring the interval from project kickoff to the point where the business begins recognizing revenue allows executives to assess how quickly IT can capitalize on market opportunities. Shorter cycles not only improve cash flow but also strengthen the organization’s ability to respond to competitive threats. By setting targets for time-to-value and reporting actual performance against those targets, CIOs reinforce their role as revenue champions rather than back-office caretakers.

Conclusion

Adopting a profit-first stance fundamentally redefines the CIO’s remit, shifting accountability from system metrics to tangible financial performance. As board members and investors demand that every IT dollar demonstrate a direct link to revenue growth and margin improvement, the evolving role of the CIO calls for fluency in P&L dynamics, tight alignment with sales and finance leadership, and disciplined portfolio management. Leaders who master this shift not only secure larger budgets and richer incentives but also position technology as a core accelerant of business value, and themselves as strategic partners in the C-suite.

Contact us today to secure your next Profit-First CIO.

FAQs

A Profit-First CIO is a technology leader whose performance is measured primarily by financial outcomes such as revenue growth, return on technology investment (ROI), customer lifetime value uplift, and profit margin contribution rather than traditional IT KPIs like system uptime or ticket volume. This role demands fluency in P&L statements and the ability to build business cases that link every IT initiative to clear profit objectives.

Key metrics for a Profit-First CIO include revenue growth directly attributable to IT initiatives, ROI calculated as net profit divided by total IT spend, uplift in customer satisfaction (often measured by Net Promoter Score), and profit margin contribution after all related costs. These measures replace traditional KPIs, such as mean time to repair or infrastructure utilization, by linking every project to the P&L and enabling boards to track how technology programs drive business growth.

To calculate ROI, a CIO should first determine the total incremental gross margin generated by the project, such as additional sales from a new digital platform, then subtract all associated costs, including development and operating expenses. Dividing that net profit by the initial investment yields the ROI percentage. This precise P&L mapping ensures that funding decisions are grounded in measurable financial returns rather than estimates of operational efficiency.

Profit-First CIOs often encounter cultural resistance teams accustomed to “keeping the lights on” may view commercial metrics as bureaucratic overhead—and legacy-system inertia, where sunk-cost biases stall modernization. Overcoming these barriers requires narrative alignment through clear storytelling that links each IT initiative to client value, executive sponsorship of early financial wins, and rigorous value-at-risk analyses that compare ongoing maintenance costs with projected margin improvements from modern platforms.

Profit-First CIOs formalize partnerships with the CFO and chief revenue officer by establishing joint governance forums and agreeing on shared KPIs, such as revenue per feature or profit margin per customer segment, to ensure alignment of IT growth strategies with corporate objectives. Quarterly business reviews assess both technical delivery and commercial impact, fostering unified accountability and enabling the CIO to position technology as a strategic lever for revenue generation alongside sales and finance leadership.

Leave a Reply