M&A Has Evolved. Has Your Leadership?

In the current M&A environment, leadership—not valuation—is the real differentiator. Let us see why traditional models fall short, and what it takes to lead successful transformations.

M&A is no longer just transactional—it’s transformational.

Success now hinges on leadership that can operate under pressure, ambiguity, and constant disruption.

Traditional leadership models are the new bottleneck.

Cultural misfires, consensus-driven indecision, and centralized control structures are quietly eroding deal value.

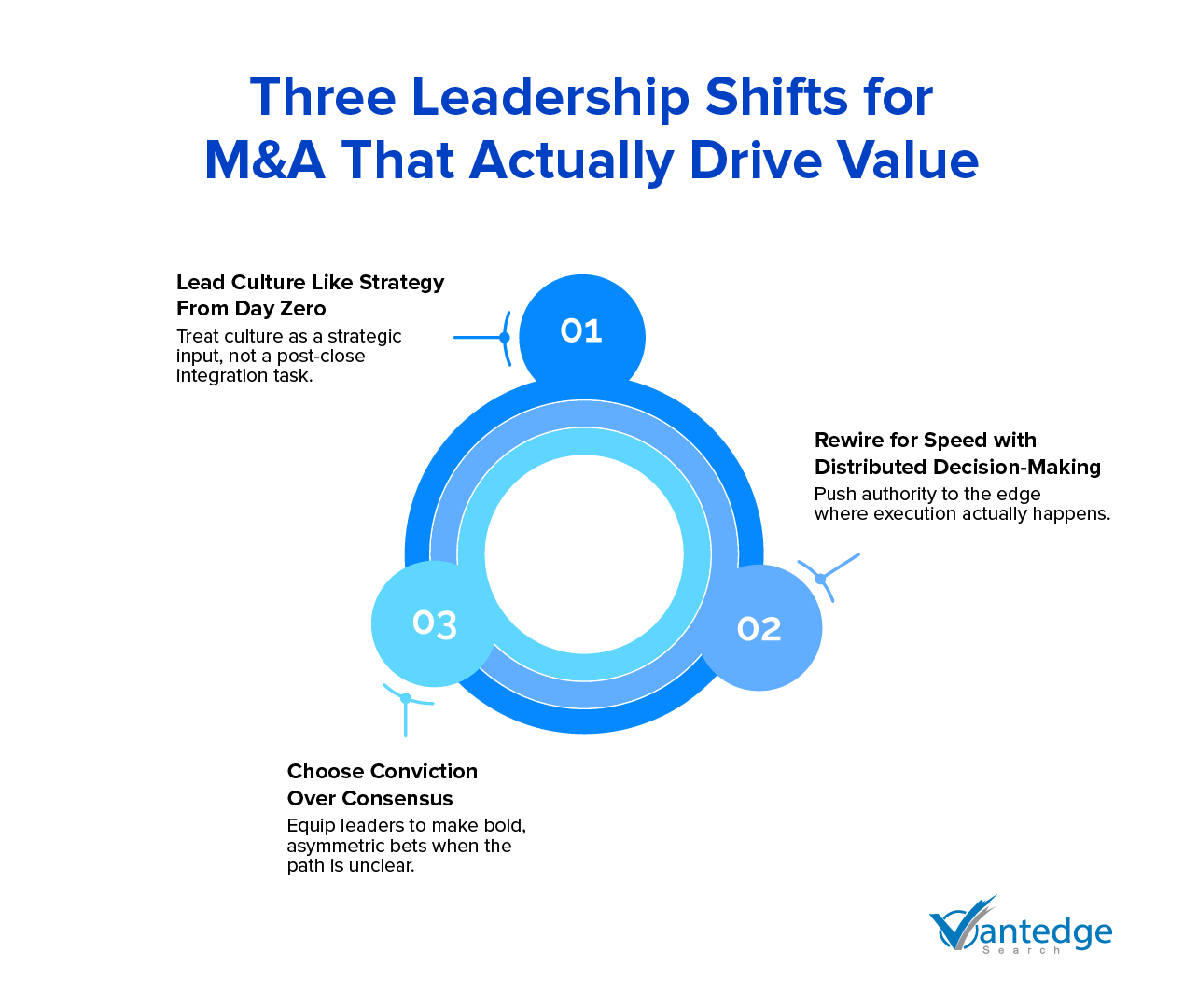

Three leadership shifts can unlock post-deal impact.

Mobilize culture early, lead with long-term conviction, and build distributed decision systems that match the speed of change.

Deals don’t fail because the numbers are wrong. They fail because M&A leadership was.

The M&A landscape is no longer linear or predictable. It’s shaped by AI cycles that move faster than your planning horizon, geopolitics that can redraw market maps overnight, and stakeholders who don’t just want growth—they want reinvention.

And yet, too many M&A leadership teams are still playing by a pre-2020 playbook: synergy spreadsheets, post-close org charts, and integration “checklists.” In this new era, that’s not just outdated—it’s dangerous.

If your leaders haven’t evolved faster than your M&A deal strategy, you’re not ready. Because in the world we’re in now, leadership agility isn’t just a success factor. It’s the risk factor in merger and acquisition strategies.

M&A Is Back—But It's Not What It Was

Global M&A is showing signs of resurgence—but not in the way most dealmakers expected. According to McKinsey in M&A 2025 Annual Report, in 2024, the total value of deals over $25 million increased by 12% to $3.4 trillion, and the number of companies changing hands rose by 8% to 7,784, up from 7,206 in 2023.

But this isn’t a return to the pre-COVID playbook.

Rather than bouncing back to blockbuster megadeals, deal activity is being reshaped by structural shifts. McKinsey highlights a strategic reset underway—one in which companies are gravitating toward smaller, more targeted acquisitions that prioritize capabilities, agility, and innovation over pure scale.

Meanwhile, valuations are normalizing, and corporate cash reserves are swelling: more than $7.5 trillion is currently sitting on non-financial balance sheets. This creates fertile ground for transformation—not just transaction.

Taken together, these trends suggest that M&A is increasingly becoming a tool for reinvention. As McKinsey notes, companies that treat M&A as a repeatable capability—what they call programmatic acquirers—outperform their peers by 2.3% in median excess TSR per year. This makes a strong case for shifting from episodic dealmaking to continuous portfolio evolution.

Yet while the strategy is evolving, the leadership architecture guiding it is often stuck in a past era.

McKinsey’s report focuses on the macro and strategic shifts in M&A, leaving room for a deeper discussion on leadership readiness. It highlights the rising influence of AI, geopolitical risk, and multi-speed markets—forces that demand leaders who can operate under pressure, in ambiguity, and at speed. We believe it’s increasingly evident that legacy leadership models may be the real bottleneck in unlocking post-deal value as part of M&A integration strategy.

We can reasonably infer that in this new era of M&A leadership, checklists and playbooks won’t be enough. What matters now is leadership agility—the ability to drive integration not from a template, but from adaptive execution aligned to the deal’s purpose.

Rethinking M&A Leadership for a New Era of Dealmaking

This brings us to a critical question: What kind of leadership is actually equipped to deliver value in this environment?

The answer may not lie with traditional dealmakers. It lies with leaders who’ve already navigated large-scale reinvention—those who’ve rebuilt operating models, shifted strategic trajectories, and galvanized organizations through volatility.

Their experiences offer more than inspiration. They provide:

- A blueprint for making decisions in ambiguity

- Playbooks for mobilizing people at scale

- And compelling proof that leadership must evolve faster than strategy

Why step outside the M&A world for insight? Because today’s transactions are no longer just financial events—they are strategic inflection points. In this context, the success of a deal hinges less on structure and more on a model built for speed, tension, and transformation to overcome the leadership challenges in mergers and acquisition.

In the next section, we distill three merger and acquisition strategies drawn from real-world reinventions—reframed through the specific lens of modern M&A leadership. These are not abstract ideals. They are grounded, applicable approaches for the kinds of deals being done today.

Because in a world where execution—not valuation—is the real test, transformational M&A leadership is no longer optional. It’s operational.

Strategy 1: Mobilize with Precision—Not After the Deal, But Before Cultural Integration in M&A

When Tufan Erginbilgiç took over as CEO of Rolls-Royce in early 2023, he didn’t ease into the role—he lit a signal fire. Declaring the company to be on a “burning platform,” he catalyzed a cultural awakening across 42,000 employees. But this wasn’t a scare tactic. It was a deliberate act of alignment—anchoring urgency, ownership, and direction in a single, unambiguous message.

For Erginbilgiç, the challenge wasn’t just operational turnaround. It was cultural rewiring. As he put it: transformation “isn’t about restructuring”—it’s about moving with intensity, pace, and rigor, supported by a leadership team that knows where they’re going and why it’s possible.

So, what does this have to do with cultural integration in M&A?

Everything.

In mergers, culture is often treated as a post-close problem—something to smooth out once synergies are modeled and org charts are redrawn. But this mindset misses the real risk. Deals rarely fail because of cultural mismatch. They fail because of cultural drift—when organizations are aligned on the value thesis but misaligned on how value is actually created, measured, and rewarded.

We believe Erginbilgiç’s example offers a vital reframing: culture isn’t a soft issue to “manage” post-integration. It’s a strategic input—one that leaders must mobilize before the deal even closes.

Transformation “isn’t about restructuring”.

Implications for the M&A Environment

The moment a deal is announced, the clock starts ticking on value realization—and, thereby, on the execution of your M&A deal strategy. But beneath the surface, cultural friction begins to erode value in subtle, often invisible ways:

- Misaligned performance norms slow execution.

- Legacy incentives pull in different directions than the integration roadmap.

- And deep-rooted behaviors quietly resist the new operating model.

That’s why leadership readiness for culture must begin with diligence, not post-close.

The Questions Boards Should Ask

- Do our cultures reinforce or undercut the value thesis?

For instance, if the deal hinges on speed and innovation, are we uniting organizations that reward autonomy—or ones designed for consensus? - Where are behaviors likely to collide—and who is prepared to navigate it?

When a top-down, performance-led culture merges with a flat, experimental one, leadership must have the tools to reconcile—not suppress—those differences. - Is there a shared view of what “good” looks like?

Without a unified definition of excellence and aligned behavioral expectations, post-close execution often devolves into turf battles and defensiveness.

Don’t Let Talent Drift Become Value Drift

Alongside cultural alignment, M&A-ready leaders must act as talent anchors—especially for high performers whose loyalty may be destabilized by ambiguity. Research consistently shows that post-deal attrition among top talent can spike when leadership fails to communicate clearly, define roles early, or reinforce individual purpose during transitions. Leaders must not only cascade strategic direction but also signal a commitment to people’s continuity. In practice, this means engaging key contributors before the deal closes, building two-way feedback loops into integration, and rewarding those willing to bridge the “old” and the “new.” Integration fails when culture misfires—but it slows down when talent walks out the door.

Where Most Merger and Acquisition Strategies Still Fall Short

Some of the most future-forward acquirers have begun treating culture as a lever, not a liability—running behavioral diagnostics, embedding cultural KPIs into integration plans, and even assigning “integration sherpas” to manage soft risks with hard discipline.

But let’s be clear: these are still the exceptions, not the norm.

In most deals, culture remains an afterthought, relegated to HR workstreams or post-close workshops. It’s rarely treated as a strategic variable in the value thesis—or as a leadership accountability before the deal is done.

That’s the gap.

Erginbilgiç’s approach at Rolls-Royce shows what’s possible when culture becomes a leadership system, not a communications initiative. The lesson for dealmakers? Cultural alignment must be led, not managed—and it starts not with slogans or surveys, but with leaders who can model the pace, direction, and mindset the future demands.

In high-stakes M&A, that’s not optional. It’s operational.

Strategy 2: Design for Long-Term Courage, Not Short-Term Consensus

Patrick Pouyanné, Chairman and CEO of TotalEnergies, is no stranger to volatility. He leads one of the world’s largest energy companies through a transformation few would dare to attempt: balancing the enduring profitability of oil with an ambitious, integrated push into renewables and electricity. His strategy pleases neither side. Traditional investors argue he’s strayed too far from fossil fuels. Climate advocates say he hasn’t gone far enough. And yet, Pouyanné holds the line—with a clarity of intent that doesn’t waver under pressure.

This kind of leadership—anchored by conviction, not consensus—is exactly what post-merger environments demand. After the announcement fades, and the integration begins, it’s not financial modeling that carries the deal forward—it’s leadership with the stamina to stay the course when pressures mount and opinions fracture.

“We’re walking a tightrope at TotalEnergies. The people who tell us we should only do oil and gas aren’t happy... and the others say we’re not good citizens for the planet. But I’m sticking to the strategy.”

“As a CEO, you also think about your legacy... If we didn’t make that decision, our successors would regret it.”

What this means for M&A

M&A deals often expose the fault lines between short-term expectations and long-term strategic intent—making a robust M&A integration strategy essential. When value creation depends on uncomfortable decisions—acquihires, restructurings, business model reinventions—the leadership that succeeds is not the most popular. It’s the most grounded, shaped by rigorous leadership due diligence.

Merger environments don’t reward safe, stakeholder-approved moves. They reward strategic bets that can withstand friction, ambiguity, and delay. And yet, too often, leadership teams default to consensus-building—mistaking alignment for impact.

In M&A, courage is a capability. And it must be assessed as one.

The Questions Boards Should Be Asking

If leadership readiness is to be a part of M&A diligence, the lens must go deeper than “Can they lead in complexity?” It must probe whether they can lead when consensus fractures. Boards and deal sponsors should ask:

- Can the executive team hold course under external criticism, internal friction, and incomplete information?

- Are they equipped to weigh trade-offs that won’t please everyone—but are right for the long game?

- Have they practiced making asymmetric, future-forward bets—not just safe, stakeholder-approved moves?

These aren’t hypothetical traits. They’re observable in how leaders have previously operated—especially in environments where value wasn’t just created, but defended.

What to Look for in M&A Leadership Today

- Long-cycle decision-making: Have they owned and executed a multiyear transformation under scrutiny?

- Resilience in the face of pushback: Do they stay anchored to the strategic center even as sentiment shifts?

- Strategic adaptability without mission drift: Can they evolve tactics without compromising the end goal?

Courage may be intangible, but its absence shows up fast post-deal—in second-guessing stalled initiatives, or worse, reversal of intent. In a market where deal strategy often shifts mid-integration, the durability of vision is not a soft skill but a structural advantage.

Conclusion: Leadership Is the Real Deal

Strategy 3: Rewire Decision-Making—From Control Center to Command Network

Michael Dell doesn’t run Dell Technologies from the top down. He never has. For him, leadership isn’t about holding the reins tighter—it’s about creating systems that move faster, think clearer, and execute smarter without waiting for permission. “You can’t manage a big organization that way [from the center] if you want to go fast,” he said. Instead, his team focuses on identifying which activities are the most important for the company and quadrupling down on those so that time can be given back to the people to more quickly do more of what matters.

That sentence isn’t about IT architecture. It’s about decision architecture—how work gets owned, prioritized, and unblocked at scale.

This is exactly where most M&A integration strategies falter. Not because the strategy was wrong or the synergies miscalculated—but because the structure of decision-making wasn’t ready for the speed, complexity, or unpredictability of post-deal execution. Integration teams get stuck. Bottlenecks pile up at the top. And value quietly erodes while everyone waits for alignment—exposing critical M&A success factors often overlooked in planning.

"You can't manage a big organization that way [from the center] if you want to go fast."

What This Means for M&A

If Dell’s model teaches us anything, it’s this: speed doesn’t come from central control. It comes from focused decentralization—empowering people closest to the work with the authority, clarity, and tools to act decisively. And in the high-pressure, time-sensitive world of post-merger integration, that isn’t just a leadership philosophy—it’s an operating necessity.

M&A doesn’t unfold in controlled conditions. Regulatory reviews shift midstream. AI disrupts entire workflows between signing and closing. And new stakeholders emerge with new expectations. The acquirers that win are not those who rely on steering committees and escalation ladders—they’re the ones who push clarity and autonomy outward, not upward.

That doesn’t mean chaos. It means zones of ownership in merger and acquisition strategies—cross-functional execution pods with defined mandates, fast decision rights, and accountability rooted in outcomes, not oversight.

The Provocation for Deal Teams and Boards

Before the deal closes, pressure-test this:

- Can your leadership model operate at distributed speed—without losing control?

- Are decision rights designed for domain proximity or legacy hierarchy?

- Where are the most critical choke points—and who is empowered to unblock them?

What Great Acquirers Are Building

To translate this into post-merger advantage, forward-thinking acquirers are rebuilding their integration model around three shifts:

- Prioritization discipline: Not all initiatives matter equally. Tier your integration goals and assign focused teams to own delivery end-to-end.

- Structural autonomy: Move beyond hub-and-spoke governance. Build agile, domain-led teams with pre-agreed thresholds for independent action.

- Systemic transparency: Enable speed with clarity. Ensure teams have shared direction, outcome visibility, and feedback loops that move faster than traditional reporting lines.

Most organizations aren’t there yet. The standard M&A playbook still defaults to central integration offices and steering committees that absorb decisions rather than accelerate them. But in an environment defined by AI disruption, geopolitical fluidity, and stakeholder scrutiny, slow is fragile and outdated M&A deal strategies won’t keep up.

The Emerging Mandate: Separation

While this piece has focused on the leadership demands of cultural integration in M&A, the opposite dynamic—separations, carve-outs, and spin-offs—is no less strategic. In fact, in many cases, value creation depends not on what a company acquires, but on what it has the courage and clarity to let go.

These scenarios place a different kind of pressure on M&A leadership. Rather than stitching organizations together, CEOs must orchestrate a controlled unbundling—one that preserves momentum, protects IP, retains critical talent, and communicates strategic intent with surgical precision. This is not just an operational challenge; it’s a cultural and emotional one.

Separation leadership demands a steady hand through uncertainty:

- Maintaining morale inside the divesting entity, even as identity and continuity are redefined.

- Managing transitions of people, systems, and customers without eroding value.

- Signaling confidence to the market that this isn’t retrenchment—it’s renewal.

Whether you’re integrating or separating, the leadership challenges in mergers and acquisition are the same at the core: sustaining clarity, momentum, and culture through disruption. Integration tests how you bring complexity together; separation tests how you let go without losing control. Both demand a leadership architecture built not just for operations—but for transformation.

Conclusion: Leadership Is the Real Deal

Whether you’re integrating a bold acquisition or carving out a legacy business, M&A is a stress test for leadership. It exposes not just strategic clarity but the capacity to lead through ambiguity, mobilize people at pace, and hold conviction when certainty is in short supply.

Because whether you’re stitching together futures or unbundling the past, the same question applies:

Is your M&A leadership architecture built for strategic change—or just operational continuity?

Is your leadership team built for the next wave of M&A?

Partner with us to assess, align, and future-proof your leadership architecture—before the deal is done.

FAQs

Today’s M&A leadership must combine strategic clarity with leadership agility—capable of navigating cultural integration in M&A, sustaining momentum, and driving transformation under pressure.

Leadership agility enables organizations to pivot fast during integration, align talent and culture, and respond to shifting market forces—making it a cornerstone of modern merger and acquisition strategies.

Often, deals falter due to poor leadership readiness—not flawed models. Without leadership due diligence and a clear M&A integration strategy, even the best financial theses fall apart.

Cultural integration in M&A is one of the most overlooked M&A success factors. Misalignment between leadership behaviors, incentives, and execution speed can quietly erode value after the deal closes.

By identifying leaders experienced in navigating leadership challenges in mergers and acquisition, executive search partners help clients find talent with a proven ability to integrate culture, retain top performers, and deliver value at scale.

Boards should assess whether executive candidates demonstrate long-cycle decision-making, resilience, and the courage to lead amid uncertainty—all critical in leadership due diligence and in sustaining M&A deal strategy execution.

Leave a Reply