Life Sciences Hiring Trends for 2026: Competing for Senior Leadership Talent

Table of Content

- What’s Shaping Senior Hiring at the Start of 2026

- Where Competition Tightens for Senior Roles in 2026

- What Senior Candidates Will Prioritize in 2026 Mandates

- Compensation and Deal Terms for 2026 Senior Hiring

- How to Win Senior Leadership Searches in a Tight Market

- A Repeatable Leadership Talent Plan for 2026 and 2027

- Conclusion

- FAQs

- 2026 hiring may cool in parts of life sciences, yet critical roles can be hard to close

Even if overall hiring slows in some segments, senior leadership searches can remain challenging. Boards would still need proven operators for high-impact mandates, as the pool of truly ready leaders does not expand overnight. - Competition tightens where governance, clinical ownership, and operations meet.

Board and enterprise roles, CMOs and development leaders, and quality, MS&T, tech ops, and site heads draw the strongest competition. - Candidates screen the mandate, not the title.

They test decision rights, sponsorship, board alignment, risk coherence, and realistic location expectations. - Searches close with discipline and preparation.

Clear mandates, discreet outreach, evidence-based assessment, and an ongoing talent plan reduce drift and improve outcomes.

As leadership teams finalize and start to execute their 2026 plans, many are trying to balance caution with decisive action. Recent work from McKinsey on life sciences and technology trends notes that companies are adjusting to uneven performance, more selective capital, and new expectations around digital and AI capabilities.

Deloitte’s 2026 global life sciences insights point to similar conditions, with executives expecting pressure on growth, productivity, and innovation, while still expressing confidence in the sector’s ability to advance science and patient impact.

This blog looks at life sciences hiring trends in 2026 through the lens of leadership hiring. It focuses on how boards, executives, investors, and people leaders can compete for scarce life sciences talent in key roles. It sets out where competition is likely to be sharpest, what strong candidates will weigh before deciding, how compensation and deal terms are likely to be shaped, and what practical steps help searches reach a decisive, high-quality hire.

What’s Shaping Senior Hiring at the Start of 2026

Three forces are expected to shape senior hiring as 2026 begins: uneven conditions across major clusters, rapid adoption of AI in both recruiting and operating models, and more pressure from portfolio choices and deal activity. Taken together, these signals raise the cost of a wrong senior hire and increase the value of leaders who can make clear decisions under scrutiny.

Hiring Cycles Across Leading Life Sciences Hubs

As 2026 approaches, hiring will likely stay uneven, with employers remaining highly selective despite rebounds in some functions. Even in established clusters, this kind of volatility changes leadership expectations. Boards care less about whether a leader can build in a straight line and more about whether a leader can hold performance steady while priorities and resources tighten.

This reality reinforces a simple point for life sciences executive search. When teams run leaner, every senior appointment carries more weight. Senior leaders are expected to set priorities, protect critical programs, and make tradeoffs early rather than late.

AI and Its Impact on Role Design and Measurement

AI adoption is expected to influence leadership mandates more than it influences job descriptions. McKinsey’s research on AI operating models points to an organizational shift toward new ways of working, including humans working alongside AI agents. This raises the premium on leaders who can set standards, build trust in decision systems, and keep accountability clear.

This creates a new leadership test. The best executives will not be selected because they are “pro AI.” They will be chosen because they can set clear standards for responsible AI use, protect quality, and manage change without losing focus on delivery.

Portfolio Decisions and Deals Raising the Bar for Leadership

Portfolio moves and deal activity will continue to raise expectations for leadership quality and speed. McKinsey’s biopharma dealmaking commentary has emphasized how much pharmaceutical innovation and revenue has depended on externally sourced products, which keeps M&A and in-licensing central to strategy.

Deloitte’s 2026 Life Sciences Outlook also pointed to portfolio pressures and competitive forces that can accelerate strategic moves.

When portfolios shift more frequently, senior leaders must evaluate assets quickly, pressure-test integration plans, and communicate clearly to boards, investors, and teams.

That dynamic changes what “ready” means. A title alone will not be persuasive. Evidence of good judgment through high-stakes resets will matter more than ever.

Where Competition Tightens for Senior Roles in 2026

In 2026, the most contested roles will likely sit where governance, clinical accountability, and operational execution intersect. Boards are expected to prioritize leaders capable of carrying risk in the open (under regulatory scrutiny and in full investor view).

Board, Chair and CEO Alignment Under Closer Scrutiny

Board oversight is set to stay active across life sciences. Deloitte’s 2026 Life Sciences Outlook frames the year as one with growth ambitions alongside a clear need for resilience, which can sharpen board focus on governance, clarity, and execution.

This context shifts what “fit” means at the very top. Boards are likely to prioritize CEOs, and board leaders who can maintain a coherent strategy story, keep decision rights clear and handle disagreement without prolonged drift. Enterprise roles such as Chief Strategy Officer or Chief Business Officer will also draw attention, because they link portfolio, markets and capital.

Clinical and Medical Leadership as a Persistent Constraint

Within life sciences hiring trends, clinical and medical leadership is expected to remain one of the most difficult segments. The constraint is not interest; it is the limited supply of leaders with end-to-end accountability for late-stage development, credible regulator engagement, and board-level communication.

This is why chief medical officer hiring and the leadership that stabilizes clinical operations recruitment are expected to remain hot spots. When the CMO function is strong, risk decisions can be framed clearly, tradeoffs can be made earlier, and cross-functional delivery can move with fewer reversals. When the role is underpowered or unclear, timelines can drift even when programs are well funded.

Operations Leadership for Advanced Manufacturing and CDMO Growth

Operations leadership is likely to stay highly competitive, especially for roles tied to quality, MS&T, technical operations and site management.

A central driver is the continued reliance on external partners across development and manufacturing. McKinsey’s work on pharma R&D supplier partnerships describes outsourcing as accelerating and highlights expectations that supplier spending could rise over the next several years.

As outsourcing and modality complexity increase, CDMO recruitment and sponsor-side hiring are likely to keep colliding for the same experienced site and network leaders.

Discuss leadership hiring with Vantedge Search now.

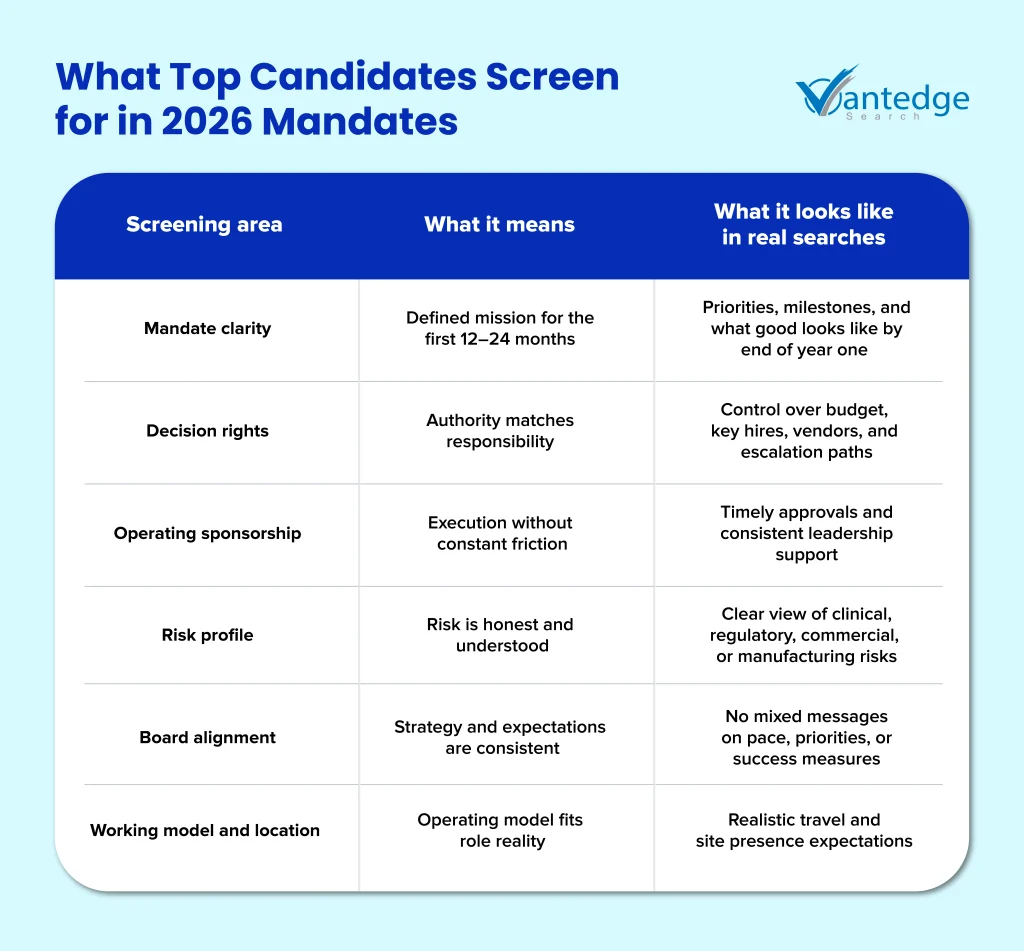

What Senior Candidates Will Prioritize in 2026 Mandates

In 2026, senior candidates are expected to not only choose a title. They are likely to choose the mandate, the decision system, and the operating environment that will shape outcomes and personal risk. In competitive biotech executive search, the strongest leaders step back early when fundamentals are unclear. This section outlines the screens that matter most.

Mandate Clarity, Decision Rights, and Sponsorship

Mandate clarity is likely to become the first and most critical screen. After several years of rapid restructuring and shifting growth narratives, senior leaders are increasingly unwilling to enter roles with undefined success metrics or blurred tradeoffs. In 2026, tighter governance, shorter performance horizons, and board-level scrutiny of pay-for-impact will likely reinforce this demand. Clear decision rights will be read as proof that the organization can move with intent — a signal of maturity that matters as much as compensation in top-tier hiring.

Sponsorship will also be tested with greater precision. Executives will seek tangible evidence that strategic intent is matched by operational backing, from the speed of budget approvals to the clarity of escalation pathways between the CEO, board, and peers. The trend toward leaner structures, shared accountability models, and cross-functional dependence is expected to amplify how candidates evaluate sponsorship strength. When these mechanisms are vague, strong candidates will interpret it not as ambiguity but as institutional fragility, and quietly step away, regardless of the headline opportunity.

Risk Profile and Board Alignment in Senior Moves

In 2026, risk coherence at the top is expected to become an even bigger decisive factor in senior candidate evaluation. As boards operate under greater regulatory exposure, compressed growth cycles, and activist visibility, alignment between directors and the CEO will be treated as a proxy for stability. Leaders have learned from recent cycles that strategic disagreement doesn’t just slow progress; it amplifies personal risk in public view. The best candidates will screen not for comfort, but for consistency: whether the board and CEO interpret urgency, accountability, and disclosure through the same lens.

This emphasis will sharpen as companies navigate faster reporting rhythms, greater investor transparency, and heightened reputational risk. Misalignment at the top now travels faster, through markets, media, and culture, making role risk less about decision quality and more about decision unity. For discerning executives, the signal will be simple: coherent boards create cover; fragmented ones create headlines.

Working Model Expectations and Location Requirements

With regard to working expectations, the issue will not be flexibility at any cost. It will be credibility. Senior candidates will look for an operating model that matches the job, particularly in site-based roles common in CDMO recruitment, where physical presence can be essential during key phases. Boards that frame expectations clearly and back them with a workable operating cadence are likely to see stronger engagement and faster closes.

Compensation and Deal Terms for 2026 Senior Hiring

In 2026, compensation is likely to function as a signal as much as a reward. Boards are expected to face pressure to demonstrate discipline and fairness, while senior candidates are likely to scrutinize how pay structures reflect risk, ownership, and long-term commitment, especially as expectations around performance alignment and governance tighten.

Pay Design to Get More Disciplined in Pre-Commercial Biotech

In pre-commercial and high-growth settings, boards are likely to put greater emphasis on coherent pay design. That often means clear ranges, explicit tradeoffs between cash and equity, and alignment with capital plans and investor expectations.

Senior candidates are expected to respond better to offers that feel consistent and defendable, even if they are not the largest on paper. Where mandates carry significant visibility and accountability, credibility of the structure will continue to outweigh small differences in headline figures.

Governance Scrutiny and Board Expectations Shape Offers

Also, offer design is likely to move toward tighter alignment with governance standards. Compensation committees may place greater emphasis on how packages are structured and explained, favoring clean documentation, a clear link between performance expectations and incentives, and a pay story that fits the company’s strategy.

For senior hiring, this shift is likely to act as a source of confidence. Candidates may read disciplined, well-structured pay programs as a sign that decision-making is consistent and that accountability is taken seriously across the organization.

How to Win Senior Leadership Searches in a Tight Market

In 2026, senior hiring will be less about reach and more about precision. As board oversight tightens and candidate mobility narrows, the organizations that consistently land high-caliber leaders will be those that treat each search as a strategic governance exercise, one that tests readiness, intent, and cultural coherence. In this environment, biotech and life sciences executive searches will double as strategy audits: every step, from the brief to the close, will reveal how clearly the board thinks and how decisively it acts.

Defining the Role Before Outreach

In 2026, defining outcomes before outreach is expected to separate disciplined boards from reactive ones.

As leadership tenures shorten, capital cycles compress, and investor visibility intensifies, ambiguity will become a hiring liability. The strongest briefs will focus not on responsibilities, but on results: what success looks like in 12 to 24 months, where accountability sits, and how decision rights flow between the CEO, board, and peers.

Candidates will read this clarity as a proxy for alignment. When outcomes, authority, and tradeoffs are vague, strong leaders disengage early, interpreting it as a signal that strategic priorities may shift once inside. In a constrained capital environment, mandate precision will likely become the new form of credibility.

Building a Credible Market Map and Running Discreet Outreach

The executive market entering 2026 is expected to be thinner, not in size but in readiness. Shrinking leadership pools — driven by (churn and burnout, tighter funding cycles, higher risk aversion, stricter cross-sector fit, and succession bottlenecks) — will make precision and discretion essential. The best searches will move quietly and target tightly: peer firms, adjacent verticals, and select geographies where proven leaders sit.

Outreach tone will matter as much as access. Senior candidates, weary of generic approaches, will respond only when the contact reflects informed intent — an understanding of their current impact, not just their title. In a credibility-driven market, every interaction will double as a reputation test: how the organization shows up in search will tell candidates how it operates under scrutiny.

Assessing for Evidence, Not Titles

Boards are expected to sharpen evaluation methods in 2026 as decision accountability becomes more public and risk appetite more visible. Rather than emphasizing pedigree or scale, assessment will center on evidence: concrete decisions, judgment under pressure, and cultural composure when outcomes falter.

Structured interviews built around real inflection points, such as a trial delay, an investor dispute, or a manufacturing setback, will reveal far more than career overviews.

The same logic will guide referencing. Targeted questions on decision quality, resilience, and cross-functional collaboration will matter more than praise. In an era when leadership credibility is as much about verification as narrative, evidence-based assessment is expected to become a quiet safeguard for both board and candidate.

Closing with Speed and Seriousness

In 2026, how an organization closes will communicate as much as whom it hires.

Compressed timelines, competing offers, and heightened candidate scrutiny will make speed and tone decisive. A process that feels deliberate yet efficient (short stages, prompt feedback, and transparent constraint management) will signal operational maturity. Delays, reversals, or ambiguity will do the opposite.

Senior candidates will likely judge seriousness not by compensation size but by how the process feels: whether the organization keeps its word, moves decisively, and manages confidentiality with respect. A disciplined close, followed by a structured onboarding plan, will signal governance strength, treating leadership hiring with the same precision reserved for capital allocation or clinical milestones.

A Repeatable Leadership Talent Plan for 2026 and 2027

The strongest organizations treat leadership hiring as a standing discipline, not a one-time event. A repeatable plan helps boards reduce scramble hiring, protect confidentiality, and keep leadership decisions tied to real milestones. It also improves judgment when multiple companies approach the same executives at the same time, which is a defining feature of current life sciences hiring trends.

Map Critical Roles Against Real Risk

Start with a live, board-level view of must-not-fail roles — CEO, CMO, heads of clinical, R&D, commercial, and quality — mapped to business milestones and exposure points. The goal is not a succession chart but a readiness model: knowing which deliverables would slip if a role went vacant, who could step in, and how fast the market could respond. In 2026–2027, this clarity will anchor judgment and prevent reactive, misaligned appointments when volatility hits.

Maintain a Standing Market Connection

Sustained market awareness is expected to replace episodic search. Boards that maintain light, ongoing contact with trusted search partners and senior talent will gain visibility into how leadership expectations, compensation norms, and mobility patterns evolve. This steady calibration helps refine mandate design and signals seriousness to top candidates who value preparedness over opportunism.

Integrate Leadership Planning into Governance

By treating executive hiring as a strategic process rather than a transaction, boards create resilience. Leadership planning should sit beside capital allocation and portfolio management as a standing agenda item: revisited quarterly, informed by data, and tied to enterprise milestones. In 2026–2027, the most credible companies will be those whose leadership transitions look intentional, not improvised.

Conclusion

Leadership scarcity is expected to remain one of the most decisive life sciences hiring trends in 2026. When the right leader is in place, decisions tend to move faster, teams align more easily, and execution risk drops. When roles are unclear or search processes lack discipline, the cost often shows up in delays and missed inflection points.

Winning organizations are most likely to treat life sciences executive search as a governed process: a clear mandate, discreet outreach, evidence-based assessment, and a serious close. The same approach is expected to apply across chief medical officer hiring, clinical operations recruitment, and CDMO recruitment, where clarity, credibility, and pace make the difference.

For confidential support on board-level and senior leadership hiring in life sciences, contact Vantedge Search. The right executive appointment now can strengthen 2026 and 2027 execution.

FAQs

As 2026 begins, leadership scarcity is set to remain a constraint even if broader hiring cools in some areas. Critical roles can still take longer because boards favor proven operators who manage risk, align teams, and deliver against milestones.

In 2026, life sciences executive search will continue to be relationship-led and confidentiality-sensitive. It will typically depend on a precise mandate, discreet outreach, and evidence-based evaluation, supporting boards in selecting leaders who carry credibility with investors and regulators.

Chief medical officer hiring will remain challenging because the role combines late-stage clinical accountability, regulator-facing judgment, and board-level communication. The pool with true end-to-end development ownership is limited, so competition concentrates quickly once a search goes live.

As outsourcing remains central to delivery models in 2026, CDMO recruitment will often compete with sponsor-side hiring for the same operations leaders. Demand will stay strong for executives who can run quality, MS&T, and tech ops under inspection pressure and partner governance.

Senior candidates compare the full deal: equity terms, vesting, performance measures, and downside protections. They also weigh board access, authority to build the team, and realistic location expectations. Coherence often beats headline cash.

Leave a Reply