RevOps to the C-Suite: Chief Revenue Officer Hiring in 2026

Table of Content

- Introduction: Why CRO hiring is at a tipping point

- The 2025 CRO Reality: Short Tenures, High Pressure

- How RevOps Became a Credible Path to the CRO Seat

- When a RevOps-to-CRO Move Makes Sense

- The Capability Model: What “CRO-ready” RevOps Leaders Look Like

- Designing a 2026 CRO Hiring Strategy that Includes RevOps Talent

- Conclusion

- FAQs

- Many chief revenue officer appointments fall short when the CRO is treated as an upgraded head of sales rather than the owner of the entire revenue engine.

- Revenue operations has evolved into a central commercial function that connects marketing, sales, customer success, pricing, and finance around one set of numbers.

- A clear capability model shows when a RevOps leader is genuinely ready for the CRO seat, with emphasis on commercial judgment, board communication, financial fluency, and field credibility.

- A dual track hiring approach allows organizations to compare traditional CRO profiles and RevOps-origin candidates using the same rigorous process, ensuring the selected leader enhances enterprise value.

Introduction: Why CRO hiring is at a tipping point

Hiring a chief revenue officer (CRO) is now one of the most consequential decisions in c-suite leadership. Across SaaS and B2B, the chief revenue officer role carries significant visibility with boards, investors, and operating partners, yet it is also one of the least stable seats at the top table.

A recent analysis places average CRO tenure somewhere between 17 and 25 months, often shorter than two full sales cycles for many companies. That volatility is not just a human resources problem. A misstep at chief revenue officer level creates direct value loss: broken continuity in key accounts, confused go-to-market teams, stalled strategic initiatives, and a reset on trust between management and the board.

When total compensation for a seasoned chief revenue officer often reaches high six figures in cash plus equity, the cost of getting this hire wrong is measured not only in salary but in missed quarters and delayed strategic moves. At the same time, the role of chief revenue officer itself has widened. McKinsey & Company describes the CRO as accountable for an integrated revenue engine that spans marketing, sales, customer success, pricing, and renewals, not simply new logo acquisition.

When total compensation for a seasoned chief revenue officer often reaches high six figures in cash plus equity, the cost of getting this hire wrong is measured not only in salary but in missed quarters and delayed strategic moves. At the same time, the role of chief revenue officer itself has widened. McKinsey & Company describes the CRO as accountable for an integrated revenue engine that spans marketing, sales, customer success, pricing, and renewals, not simply new logo acquisition.

CRO responsibilities now include aligning these functions around a single plan, a unified view of the customer, and a shared set of metrics. This is no longer just a senior sales title. It is a coordination role at the core of C-suite leadership.

In this blog, we discuss why the chief revenue officer role has become fragile, how revenue operations now sits at the center of growth decisions, when a RevOps to CRO transition is appropriate, and how to shape a 2026 hiring plan that includes revenue operations talent without lowering the bar for C-suite leadership.

The 2025 CRO Reality: Short Tenures, High Pressure

As 2025 draws to a close, the chief revenue officer sits at the crossroads of growth, capital efficiency, and investor confidence. Yet for many organizations, this is still one of the most fragile seats in C-suite leadership. Boards now expect the chief revenue officer’s role to stabilize revenue; sharpen unit economics; and bring clarity across marketing, sales, and customer success.

What is Actually Happening

Across SaaS and B2B, the average tenure of a chief revenue officer is notably brief, often around two years or less. Many CROs leave, or are transitioned out, before they have the chance to see the effect of their decisions on a full cycle of pipeline build, closing, renewal, and expansion.

At the same time, compensation for proven CROs has increased. In growth-stage SaaS, it is common to see high six-figure on-target earnings, with meaningful equity grants and performance upside. The decision to appoint a new chief revenue officer, therefore, carries both direct cost and signaling weight for investors and operating partners.

Where Many CRO Appointments Go Wrong

The most common pattern is straightforward. A company hires a star sales leader into a CRO title and expects structural change without changing the underlying authority structure. The new chief revenue officer inherits an existing marketing approach, a separate customer success organization, and a revenue operations function that is treated as a support team.

Without clear control over how leads are generated, how accounts are nurtured, how success teams are measured, and how revenue operations priorities are set, even experienced CROs struggle. They can drive short-term activity, raise quotas, and push harder on pipeline, but the systemic issues that affect conversion, retention, and expansion remain largely intact.

What Boards Are Looking for Now

Boards and investors have responded by raising the bar for the chief revenue officer. They now look for a leader who can:

- Accept clear accountability for new business, expansion, and retention, not only new logo sales.

- Demonstrate a rigorous command of unit economics, including CAC, payback periods, sales productivity, and net revenue retention.

- Work as a visible partner to finance, product, and revenue operations rather than treating those functions as support.

How RevOps Became a Credible Path to the CRO Seat

Across SaaS and B2B, revenue operations has evolved from a support function in the background to a central commercial discipline. For many companies entering 2026, the person who understands how revenue is actually generated, measured, and defended across the customer lifecycle, is not the most senior salesperson, but the head of revenue operations.

From Support Function to Commercial Hub

Current definitions from major vendors and advisory firms describe revenue operations as a strategic function that aligns sales, marketing, and customer success, often in close coordination with finance. The goal is to give the organization one view of the revenue cycle, from first touch through renewal and expansion. That is a direct precondition for a modern chief revenue officer who is expected to manage the full customer journey rather than just acquisition.

In parallel, the market has started to recognize revenue operations as a senior path. LinkedIn’s “jobs on the rise” lists have highlighted director of revenue operations among the fastest growing roles. For many companies, appointing a senior RevOps leader is now one of the early signals of maturity in their go-to market organization.

What RevOps Actually Owns Today

To understand why RevOps can be a feeder for the chief revenue officer role, it helps to spell out revenue operations responsibilities as they have evolved in 2024 and 2025. Most established RevOps teams carry four main pillars of work.

- Go to market architecture

Revenue operations as a function shapes segmentation, territory design, account assignment, coverage models, and often partner strategy. They advise on which markets to prioritize; which segments to serve with which motions; and how to balance inbound, outbound, and partner routes. - Systems and data

RevOps typically owns the CRM, marketing automation platform, sales engagement tools, CPQ, and reporting stack. They are accountable for data quality and for the flow of information between teams. - Analytics and planning

Revenue operations runs pipeline reviews, forecast models, capacity planning, territory coverage analysis, and the core dashboards that boards see. A recent report by Highspot describes RevOps as responsible for aligning metrics across teams and for advancing revenue predictability. - Cadence and governance

RevOps often sets the rhythm for forecast calls, leadership reviews, QBRs, and annual planning cycles. This is where strategic decisions on investment, headcount, and target setting are translated into specific actions

The “Shadow CRO” Effect

In many mid-market and growth-stage companies, the senior RevOps leader already behaves like a chief revenue officer, even if they don’t hold the title. They are the one who can explain why conversion rates moved, why payback periods are lengthening, or where margin is eroding across the customer lifecycle. They often act as the bridge between commercial leaders and finance, and they help the CEO interpret what is really happening in the numbers.

At the same time, research points out that organizations with well-structured revenue operations teams tend to achieve stronger revenue growth and higher profitability than peers without such a function. That correlation does not prove causation, but it reinforces a simple observation. Revenue operations, when done well, is integral to the CRO’s responsibilities.

Connect with Vantedge Search today to discuss your C-suite hiring plan.

When a RevOps-to-CRO Move Makes Sense

Choosing a chief revenue officer is a capital decision, not a hiring transaction. Boards and investors want a leader who can own the full revenue engine and protect value creation.

Contexts Where RevOps-origin CROs Tend to Thrive

A RevOps leader is a strong candidate when the business is mid-stage with genuine complexity, typically multiple products, mixed motions, and more than one region. The role of chief revenue officer in these settings demands system design, clear unit economics, and tight alignment with finance and product. Indicators include:

- Annual recurring revenue in a range where cross-functional friction is the constraint rather than basic demand creation.

- Revenue operations responsibilities that already cover segmentation, coverage, pricing input, capacity planning, and forecast rhythm.

- Reliable data foundations across CRM, marketing automation, and billing, with single definitions for pipeline, conversion, and NRR.

- A leadership culture that prizes clarity of plan, disciplined cadence, and evidence-based debate.

- Investors pushing for efficient growth, payback control, and disciplined capital allocation.

- Sales, marketing, and customer success leaders who already treat the RevOps head as a peer and decision partner.

Contexts Where it May not be the Right Move Yet

There are also contexts where a different approach is better, or where Hiring head of revenue vs CRO is the more appropriate question. Warning signs include:

- Very early stage companies where founders and a small sales group still close most revenue and the primary problem is building repeatable new business.

- Organizations with weak data quality, fragmented systems, and limited planning discipline, where RevOps is still a basic reporting or tooling function.

- Turnaround situations where the immediate need is to raise field performance, reset culture in the sales organization, and restore confidence with customers.

In these cases, the board may be better served by a highly experienced sales-led leader or by an interim head of revenue structure while the business matures.

A Quick Diagnostic for Decision-makers

Board members, CEOs, and investors can rely on the following prompts when deciding whether to include a RevOps leader on the CRO slate:

- Do we need a system builder for the entire revenue cycle rather than only a strong closer?

- Do we already depend on our RevOps head for decisions on targets, territories, and headcount?

- Are board discussions on revenue now focused on net revenue retention, payback, and productivity as much as bookings?

- Would sales and customer success leaders willingly follow this person as a peer in c-suite leadership?

- Can this candidate discuss P&L impact and risk scenarios with the same confidence they apply to dashboards?

If most of these answers are positive, a RevOps to CRO transition is at least worth serious consideration.

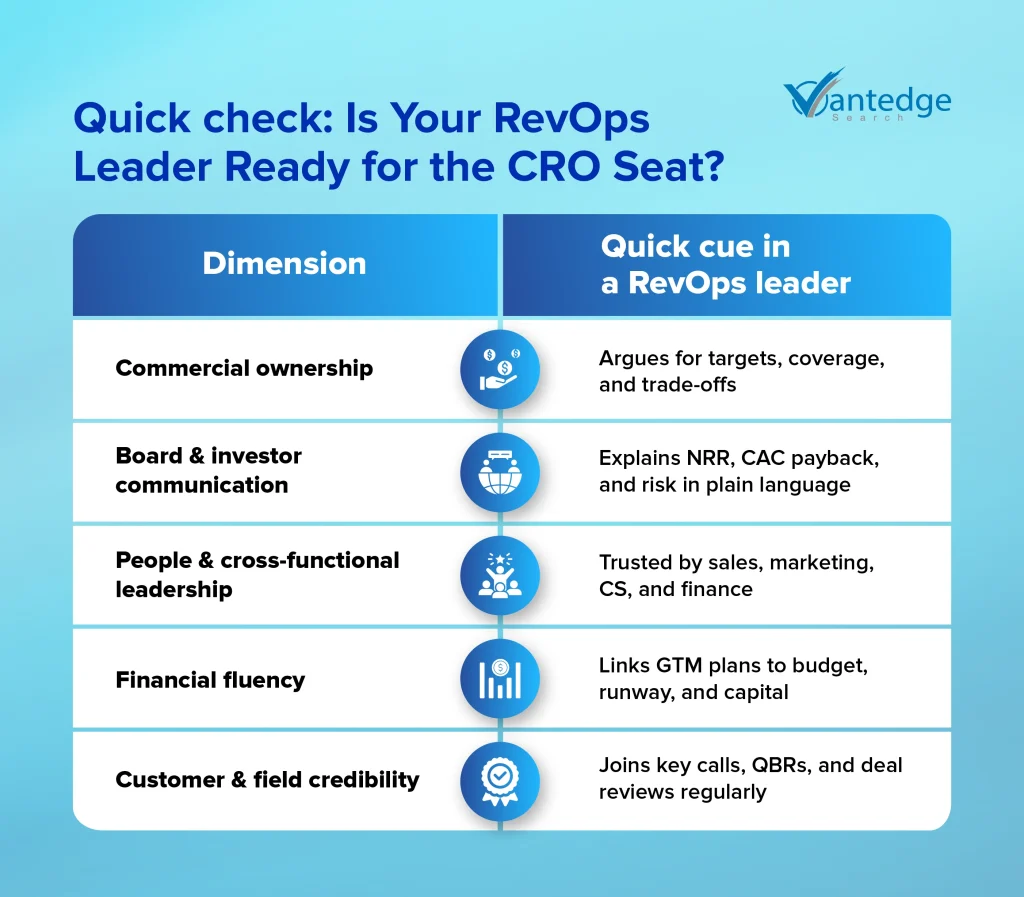

The Capability Model: What “CRO-ready” RevOps Leaders Look Like

Once a board or CEO decides that a RevOps to CRO transition is worth serious consideration, the next question is sharper: which specific RevOps leader is ready for c-suite leadership, and which one is not. Title alone is not enough. The revenue operations career path can produce outstanding systems thinkers, but not all of them are prepared for the role of chief revenue officer with board visibility and full accountability for the number.

The following model will give decision makers a structured way to judge readiness.

Dimension 1: Commercial Ownership and Judgment

A CRO-ready RevOps leader already behaves like an owner of the revenue engine, not a service provider. They argue for specific targets, coverage models, and investment choices, and they do so with clear reasoning rooted in both numbers and field input.

Boards should look for examples where this person has shaped segmentation, territory design, and headcount plans, and stood by those choices through the year. When data conflicts with sales opinion, they can explain the trade-off and recommend a path, rather than simply presenting reports and stepping back.

Dimension 2: Board and Investor Communication

The role of chief revenue officer involves regular contact with investors and audit committees. A RevOps leader who is ready for that seat can turn complex data into calm, plain language. They can explain net revenue retention, CAC payback, productivity, and cohort health without jargon.

In meetings, they answer questions directly, acknowledge risk clearly, and describe corrective actions with discipline rather than optimism. This is where many otherwise strong operators fall short. A RevOps candidate who treats board sessions as a technical review, rather than a strategic conversation, is not yet ready for the chief revenue officer role.

Dimension 3: People Leadership and Cross-Functional Influence

Revenue operations responsibilities already require coordination across sales, marketing, customer success, and finance. The question is whether the individual has turned that position into real leadership.

CRO-ready RevOps leaders have built credible teams of analysts, systems specialists, and program managers. They have held that group to high standards yet retained key contributors. More importantly, peer leaders in sales, marketing, customer success, and finance describe them as a trusted partner who can hold tension without damaging relationships. References from these peers often reveal more about c-suite readiness than any interview.

Dimension 4: Financial and Operational Fluency

A modern chief revenue officer is a partner to the CFO. The RevOps candidate must understand budget cycles, margin, and cash implications well enough to argue for or against go-to market investments.

Signs of readiness include co-ownership of planning with finance; direct involvement in building investment cases for headcount or program spend; and a clear view of how changes in coverage, pricing, or compensation flow into the income statement. In review meetings, this person should be able to move from pipeline metrics to P&L impact without losing the thread.

Dimension 5: Customer and Field Credibility

Finally, no chief revenue officer can succeed without the respect of frontline teams and key accounts. A serious RevOps to CRO transition requires real customer exposure.

Board members and CEOs should look for a pattern of participation in customer calls, QBRs, renewal reviews, and deal strategy sessions. Frontline managers should describe this person as someone who helps win and keep accounts, not just interpret dashboards. When a large renewal is at risk or a strategic prospect is in play, field leaders should welcome this RevOps head in the room. That reaction is a strong signal that the candidate can move into the chief revenue officer seat without losing the support of those who carry the quota.

Designing a 2026 CRO Hiring Strategy that Includes RevOps Talent

For boards, CEOs, founders, and investors, the goal is not simply to fill a vacancy. It is to secure a chief revenue officer who protects enterprise value and aligns with the ownership thesis.

Default to a Dual-Track Slate

For any 2026 process, hiring sponsors can instruct their SaaS executive search partner to build two parallel streams of candidates:

- Proven chief revenue officer or head of sales profiles with full funnel exposure.

- Senior revenue operations leaders whose work already spans strategy, planning, and cross functional alignment.

The role description should state clearly that the company is open to both backgrounds for the chief revenue officer seat. It should set out expectations around ownership of the complete revenue engine, partnership with finance and product, and close collaboration with revenue ops services rather than superficial coordination.

Assessment Design for 2026

Selection then needs to move beyond resumes. Boards and CEOs may ask every shortlisted candidate, whether CRO or RevOps origin, to complete:

- A working session based on real numbers from the business, asking for choices on investment, hiring, and trade-offs between growth and cash preservation.

- A cross-functional discussion with leaders from sales, marketing, customer success, finance, and revenue operations, observed by the hiring committee.

These settings reveal how a prospective chief revenue officer reasons under pressure, how they listen to specialists, and how they hold their ground in front of peers. References should then probe missed quarters, pricing and packaging changes, and moments where the candidate challenged consensus.

Practical Takeaways for Leaders and Candidates

For companies, a clear decision framework around Hiring head of revenue vs CRO, and around RevOps to CRO transition, sends a strong signal to investors and internal talent.

For senior RevOps leaders, the message is straightforward. Those who seek the chief revenue officer role need visible board exposure, regular customer contact, and direct involvement in planning that touches the P&L.

Conclusion

The pattern is clear. The chief revenue officer role has an outsized impact on growth, capital efficiency, and investor confidence, yet many appointments are short and unsettled. Too often, companies hire a celebrated sales leader into the CRO role, leave the underlying structure untouched and then repeat the cycle after another 18 months. That approach exposes the business and the board to unnecessary risk.

At the same time, revenue operations has grown into one of the few functions that truly sees the entire revenue system. Senior RevOps leaders understand how marketing, sales, customer success, pricing, and finance intersect. In several SaaS and B2B companies, the head of revenue operations already behaves like the architect of the revenue engine.

At Vantedge Search, we work with boards, CEOs, founders, and investors on senior commercial appointments where the cost of a misstep is high.

If you need a discreet view of the market and a shortlist of leaders who fit both your numbers and your governance standards, reach us today.

FAQs

CROs are often hired into high-pressure situations with aggressive growth targets but limited control over the full revenue engine. When structure, data, and cross-functional alignment are weak, even strong CROs struggle to show results quickly, which leads to turnover in roughly two years in many SaaS and B2B businesses.

Yes, in the right context, a senior RevOps leader can be a strong chief revenue officer, especially where the CRO mandate is system-focused. The best candidates already shape segmentation, coverage, planning, GTM systems, and board-level metrics, and are trusted by sales, marketing, customer success, and finance.

Modern CROs need system design and commercial judgment, strong command of unit economics, credibility with customers and field teams, and the ability to work as a true partner to finance, product, and RevOps. Communication with boards and investors is just as important as deal-making or sales coaching.

A RevOps-origin CRO makes most sense once the company has real GTM complexity, reliable data, and investor focus on efficient growth, not just top-line. In very early stages, or where the core issue is basic sales execution, a traditional sales-led profile or head of revenue can be a better first step.

A VP of Sales primarily owns new business and sales execution. A chief revenue officer is accountable for the entire revenue engine across marketing, sales, customer success, renewals, and often pricing or partners, with responsibility for growth quality, predictability, and capital efficiency at C-suite level.

Leave a Reply