The Rise of the Chief Sustainability Officer: Green Leadership Takes Center Stage

Table of Content

- How the Chief Sustainability Officer (CSO) Position Emerged

- Strategic Mandates for Today’s Chief Sustainability Officer

- Essential Skills and Competencies

- Embedding Sustainability into Corporate Structures

- How CSOs in Major Enterprises are Leading Change

- Common Obstacles and Mitigation

- Measurement, Reporting and Assurance

- Conclusion

- FAQs

- Companies face mounting pressure from investors, regulators and customers to tie financing and brand reputation directly to transparent ESG performance.

- The Chief Sustainability Officer (CSO) role has shifted from a narrow compliance function to a board-level strategic advisor reporting directly to the CEO or governance committees.

- Today’s CSOs drive enterprise value by embedding sustainability across governance structures, cross-functional teams, and risk-management processes.

- Effective CSOs combine deep technical expertise (e.g., GHG accounting, scope 3 due diligence), analytical rigor, leadership presence and change-management skills to turn ESG metrics into corporate priorities.

Corporate governance is under unprecedented scrutiny from investors, regulators and customers demanding transparency in environmental and social performance. Investors are increasingly linking fund mandates to ESG deliverables, triggering asset reallocation for managers who fail to meet climate and social criteria. Customers are likewise factoring brand sustainability records into purchasing decisions, holding companies to account for their climate and social commitments.

ESG ratings now influence access to debt and equity capital, with insurers reporting that stronger ESG scores correlate with lower cost of financing and more favorable lending terms. Leading asset managers and credit agencies integrate ESG assessments into financing decisions, treating sustainability performance as a core risk indicator. As public companies face rising compliance requirements and governance pressure, they must enforce actions and report consistently for various stakeholder, ranging from SEC inquiries to class-action claims, boards must treat sustainability metrics with the same rigor applied to financial disclosures.

Against this backdrop, the Chief Sustainability Officer (CSO) has evolved from a compliance officer in charge of isolated initiatives to a strategic advisor guiding enterprise priorities. As an architect of corporate purpose and risk counsel, today’s CSO often reports directly to the CEO or a dedicated board committee, shaping long-term strategy at the highest level. In this blog, we cover the mandates, competencies, structures, obstacles and pathways for board-level sustainability leadership and the role executive search plays in securing these pivotal appointments.

How the Chief Sustainability Officer (CSO) Position Emerged

Corporate sustainability roles began as narrow compliance functions before growing into dedicated executive offices tasked with steering enterprise strategy.

- Early roots in compliance (late 1980s–1990s): Companies first appointed Environmental Compliance Officers to meet emerging regulations on emissions and waste. These roles focused on reporting under treaties like the Kyoto Protocol, which established binding greenhouse-gas targets and a compliance system for signatory nations.

- Shift to CSR management (mid-2000s): The dot-com crash and the 2008 financial crisis thrust social responsibility into public view. Firms responded by creating CSR manager positions to oversee philanthropy and initial sustainability disclosures, as ESG terminology entered mainstream business dialogue around 2005.

- Regulatory inflection points: The Kyoto Protocol (1997) laid the groundwork for emissions reporting; the Paris Agreement (2015) further required parties to embed climate-risk considerations into corporate governance, accelerating demand for board-level sustainability expertise.

- Investor pressure: By the mid-2010s, leading asset managers such as BlackRock and Vanguard began integrating ESG criteria into capital-allocation decisions. Surveys show nearly half of major investors now rate ESG as an especially crucial factor, linking sustainability scores directly to investment risk assessments.

- Consumer activism: Social media campaigns and brand boycotts have held companies accountable for green claims, driving boards to assign clear responsibility for reputation and product-level impacts. Corporate activism in consumer sectors has made sustainability leadership a board concern.

Secure expert CSO

Leadership today

Strategic Mandates for Today’s Chief Sustainability Officer

Today’s Chief Sustainability Officer works as a strategic partner at the highest level of the enterprise, securing direct board and CEO engagement, orchestrating cross-departmental collaboration, shaping formal governance and policy frameworks, and leading robust risk-management processes. This mandate ensures that sustainability objectives advance core business goals, safeguard stakeholder trust, and address both emerging opportunities and material threats.

Board Interface

- Modern CSOs often report directly to the CEO or sit on executive board committees, granting them authority to embed sustainability within core strategy.

- A strong reporting line to the CEO or the Nominating and Corporate Governance Committee ensures that sustainability considerations influence merger decisions, capital investments and public disclosures.

- Boards that partner closely with CSOs take more effective decisions when taking advantage of ESG insights across audit, risk, and compensation agendas, accelerating value creation while mitigating potential liabilities.

Cross-Functional Reach

- Sustainability is inherently cross-departmental: Chief Sustainability Officers assemble teams across procurement, operations, marketing and finance to align targets with day-to-day activities.

- Many organizations staff their CSO with six direct reports and distribute additional ESG roles across functions such as environment, health & safety, supply-chain and corporate communications.

- By breaking down silos through permanent governance structures, CSOs ensure consistent data flows, unified performance metrics and synchronized execution of sustainability initiatives.

Governance and Policy

- CSOs establish internal standards for sustainability performance, set disclosure protocols aligned with frameworks like TCFD or SASB, and advise on regulatory compliance.

- Formal board committees—such as Sustainability Committees, Audit & Risk, and Compensation—are co-chaired or regularly briefed by the CSO to embed accountability into executive compensation and risk-assessment processes.

- At leading firms, the CSO chairs or co-leads an ESG Steering Team that reports twice annually to both the board and senior management, driving policy alignment and resource allocation.

Risk Management

- A primary CSO responsibility is to identify physical, regulatory and reputational threats arising from environmental and social impacts—and to implement mitigation frameworks accordingly.

- Historically positioned to deflect reputational risk through targeted communications, today’s CSOs partner with enterprise-risk teams to integrate sustainability into business-continuity and crisis-response plans.

- Effective risk oversight by the CSO protects brand value, underpins credit-rating assessments and reduces exposure to fines or litigation tied to ESG non-compliance.

Essential Skills and Competencies

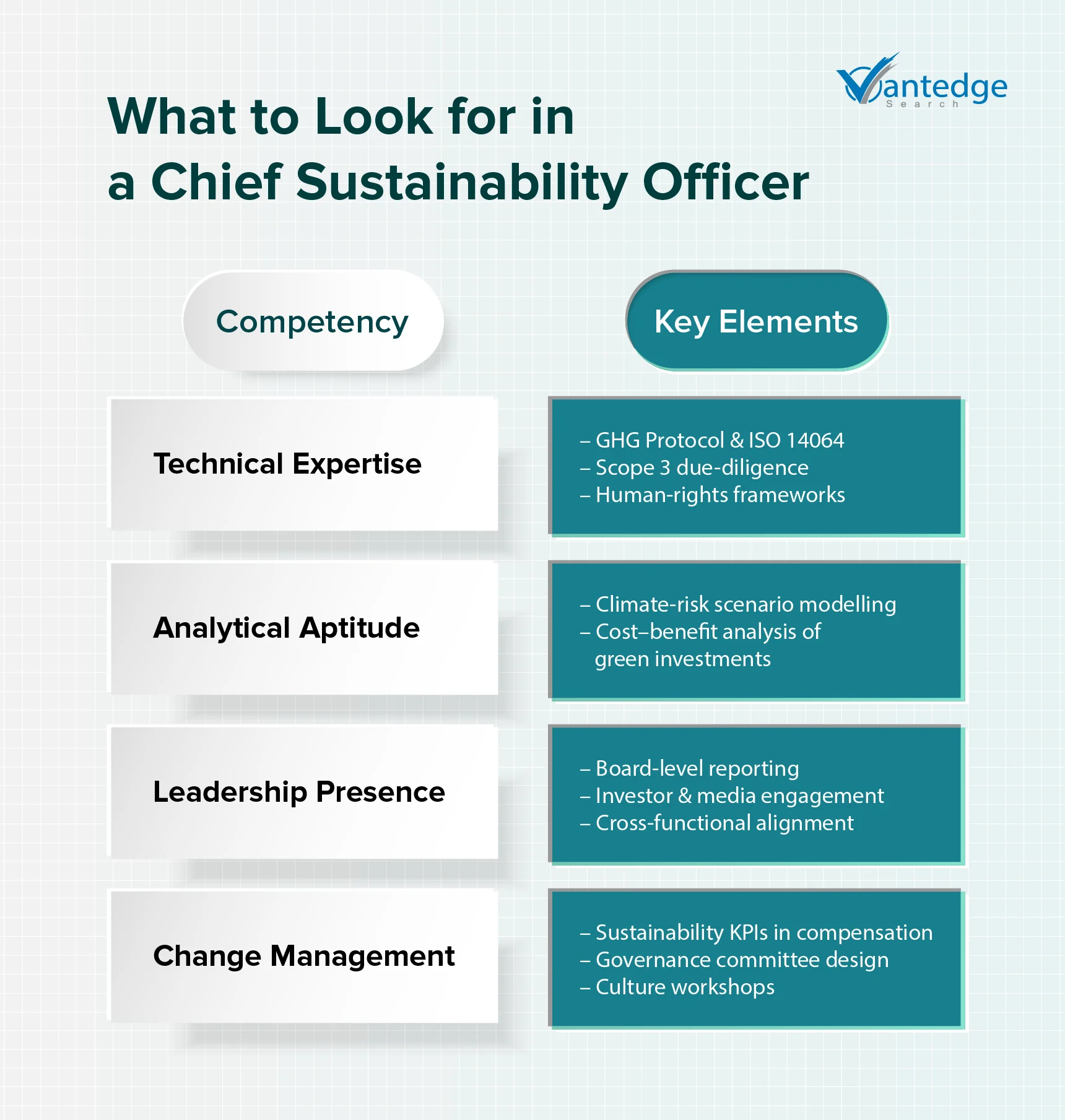

Chief Sustainability Officers (CSOs) must combine specialized technical knowledge, rigorous analytical skills, influential leadership capabilities and adept change-management proficiency to embed sustainability into corporate strategy, mitigate risks and drive enduring value across the enterprise. These competencies enable CSOs to translate complex environmental data into strategic decisions, engage diverse stakeholders with credibility and guide culture shifts that align incentives with long-term resilience.

Technical Expertise

- Carbon accounting frameworks: Mastery of the GHG Protocol Corporate Standard and ISO 14064 provides the basis for accurate emissions inventories and reporting.

- Supply-chain due diligence: Ability to assess upstream and downstream risks—such as scope 3 emissions—ensures that procurement and logistics conform to sustainability criteria.

- Human rights and social standards: Familiarity with frameworks like the UN Guiding Principles on Business and Human Rights equips CSOs to safeguard labor rights and community welfare in global operations.

Analytical Aptitude

- Data interpretation and scenario modelling: CSOs translate sustainability metrics into financial projections, stress-testing climate risks under multiple scenarios to inform investment and divestment decisions.

- Cost–benefit analysis: Evaluating the return on green investments—such as energy-efficiency upgrades—requires quantifying both direct savings and balance sheet implications.

Leadership Presence

- Board-level communication: Articulating sustainability impacts in boardrooms demands clarity, precision and an understanding of corporate governance imperatives.

- Stakeholder engagement: Building trust with investors, NGOs and community leaders hinges on transparent dialogue, active listening and tailored messaging.

- Brand ambassadorship: CSOs often serve as the public face of the company’s sustainability agenda, requiring polished presentation and media-relations skills.

Change Management

- Culture-shift interventions: Designing formal policies (new metrics, governance committees) and informal forums (workshops, peer networks) accelerates adoption across functions.

- Incentive alignment: Embedding sustainability KPIs into executive compensation and performance reviews secures accountability and sustained engagement.

Embedding Sustainability into Corporate Structures

- Governance Frameworks

Boards adopt one of six models for ESG oversight—fully integrated across all board activities, a dedicated sustainability committee, or adding ESG to existing committee charters—ensuring clear accountability and regular reporting.Audit and risk committees often co-lead ESG disclosure and assurance, aligning sustainability reporting with financial controls and external audits.

- Organizational Models

Many firms centralize the CSO office, granting it direct budget and staff to coordinate cross-functional teams; others embed “sustainability champions” in procurement, operations and communications functions for grassroots engagementA dual-model approach—central leadership plus distributed liaisons—enables agile response to site-level risks while preserving enterprise-wide consistency.

- Performance Metrics

Linking pay to sustainability outcomes has gained traction: 69% of S&P 500 firms now tie incentive compensation to at least one ESG metric, including emissions reduction, safety and DE&I targets.In Europe, 42% of top companies incorporate ESG factors into executive pay, with France leading at 70% adoption.

Major brands such as Danone allocate up to 20% of variable pay to social and environmental goals, using multi-year CDP scores for long-term awards.

By 2023, 54% of S&P 500 companies had embedded climate-related metrics in annual and long-term incentive plans, up from 25% in 2021.

- Digital Tools

Enterprise ESG platforms—such as Enablon, Intelex and Sphera—aggregate data feeds for real-time tracking and customizable reporting, enabling audit-ready disclosures.Specialized software like Novisto provides an “accounting-style” system of record for sustainability, automating data workflows and enhancing transparency.

Modern solutions integrate predictive analytics, scenario modelling and third-party assurance modules, empowering CSOs to anticipate risks and quantify value from green investments.

How CSOs in Major Enterprises are Leading Change

Below are three real-world examples showing how empowered CSOs have driven measurable sustainability outcomes through clear targets, cross-functional engagement, and strategic investments.

1. Global Consumer Goods Leader:

Unilever’s Chief Sustainability Officer guided the Climate Transition Action Plan, targeting a 70% reduction in Scope 1 & 2 emissions by 2025 against a 2015 baseline—achieved two years early in 2023 with a 74% cut.

- Financial impact: Through its Sustainable Living Plan, Unilever avoided over €1 billion in operational costs by improving water and energy efficiency across.

- Debt-market recognition: In May 2023, Fitch affirmed Unilever’s Long-Term IDR at “A” with a stable outlook, citing strong ESG integration and performance.

2. Major Technology Firm: Microsoft

Microsoft’s Sustainability team has built a proprietary supplier engagement platform, mandating annual emissions disclosures for its top suppliers and expanding an internal carbon-fee to include Scope 3 emissions.

- Supplier outcomes: Top suppliers have enhanced data quality—achieving a 95% disclosure rate—and committed to science-based targets, laying foundations to reduce Scope 3 emissions by 30% by 2030.

- Renewable energy procurement: In early 2025, Microsoft signed virtual PPAs totaling 389 MW with EDP Renewables in the U.S. and 420 MW with European Energy and Repsol across Europe, directly tying emissions-related performance to energy sourcing.

3. International Retail Chain: Walmart

Walmart’s Project Gigaton invited over 5,900 suppliers to set targets across energy, waste, packaging and more, aiming to avoid 1 billion MT CO₂e by 2030.

- Emissions avoided: Suppliers cumulatively reported 750,000 KT CO₂e avoided by 2022, more than 75% of the 2030 goal—through energy efficiency, sustainable agriculture and waste reduction measures.

- Waste diversion & circular packaging: In 2023, Walmart diverted 83.5% of global operational waste from landfill and incineration, and vendor partners recycled 280 million lbs. of plastic film and rigid plastics, thereby offsetting costs and creating recyclable material streams.

- Reputation uplift: CDP awarded Walmart an A grade for climate disclosure in 2019, reflecting strengthened stakeholder trust and board-level confidence.

Common Obstacles and Mitigation

1. Short-Term Profit Bias

Boards and investors often demand immediate financial returns, creating pressure to defer or scale back sustainability initiatives that yield returns over multiple years.

- Evidence of the tension: A Sloan Management Review survey found that more than 60 percent of executives agree that short-term financial performance pressures make it difficult to shift toward sustainable business models.

- Impact on CSO mandate: Such profit-first mindsets can relegate sustainability to a discretionary budget line rather than a strategic priority, undercutting long-term resilience and stakeholder trust.

Mitigation—Scenario Planning

- CSOs integrate climate and regulatory scenarios into board briefings, modeling outcomes under different trajectories (e.g., a 1.5 °C versus 3 °C world) to demonstrate how deferred action increases risk and cost.

- By quantifying potential liabilities (carbon pricing, supply disruptions) alongside opportunities (energy savings, new markets), scenario analysis aligns sustainability with financial planning and risk management.

2. Data Inconsistency and Fragmentation

ESG data often resides in disparate spreadsheets, unverified supplier reports, and legacy systems, resulting in gaps and incomparable metrics.

- Quality concerns: Over 85 percent of companies use multiple reporting frameworks, leading to mismatched definitions and measurement methods.

- Reliability issues: Executives rank data quality among their top three ESG challenges, with 88 percent citing inconsistent or incomplete data as a major barrier.

Mitigation—Phased Investment in Data Infrastructure

- CSOs secure dedicated budgets in three stages—due diligence, core integration and continuous improvement—mirroring best practices in sustainable investing (pre-investment, investment and portfolio management) to build an audit-ready data environment.

- Early phases focus on system selection and pilot integrations; mid-phases roll out automation and AI analytics; later phases embed third-party assurance and real-time dashboards for executive reporting.

3. Talent Gaps in Sustainability Leadership

There is a shortage of executives who combine deep environmental expertise with board-level experience and influence.

- Recruitment challenges: Nearly one-third of sustainability leaders report difficulty hiring or retaining green talent, especially for senior roles.

- Burnout risk: CSOs often struggle to manage the breadth of expectations—from technical accounting to stakeholder engagement—leading to turnover and operational strain.

Mitigation—External Partnerships and Development Pathways

- Executive search firms can partner with universities and professional bodies (e.g., ISSP, UN PRI) to find and cultivate high-potential candidates through fellowships, certifications and cross-industry mentoring.

- Organizations can set up rotational leadership programs that embed emerging sustainability talent into finance, operations and supply-chain teams, accelerating skill development and board exposure.

4. Regulatory Flux and Reporting Uncertainty

Rapidly changing rules—from the EU’s Corporate Sustainability Reporting Directive to voluntary frameworks like TCFD—can render policies obsolete and divert resources to compliance firefighting.

- Shifting mandates: Recent proposals in Brussels scaled back planned reporting requirements, creating uncertainty about scope and timelines.

- Compliance risk: Inconsistent national standards and enforcement increase the likelihood of restatements, fines or litigation related to ESG disclosures.

Mitigation—Strategic Partnerships with Advisors

- CSOs forge retainers with specialized law firms, accounting auditors and ESG consultancies to receive real-time updates on regulatory developments, interpreting implications for capital projects and reporting cycles.

- Joint working groups with peer companies and industry associations co-draft guidance and share best practices, smoothing transitions when rules change and presenting unified positions to regulators.

Measurement, Reporting and Assurance

Companies now anchor their sustainability commitments in rigorous measurement, standardized reporting frameworks and independent assurance to maintain stakeholder trust and align non-financial metrics with board-level oversight. Three leading disclosure standards, namely Task Force on Climate-related Financial Disclosures (TCFD), Sustainability Accounting Standards Board (SASB), and Global Reporting Initiative, (GRI), have seen widespread adoption across industries, with support from thousands of organizations and the vast majority of leading corporations. Integrating sustainability metrics into financial statements helps quantify cost avoidance, revenue potential and balance sheet liabilities, reinforcing the business case for environmental and social investments. Moreover, independent third-party assurance of ESG disclosures offered by auditors and specialized providers builds credibility, mitigates compliance risk, and enhances access to capital by validating reported data.

Preferred Frameworks

- TCFD (Task Force on Climate-Related Financial Disclosures): Provides 11 recommended disclosures across governance, strategy, risk management, and metrics & targets; supported by over 4,000 organizations and endorsed by 97 of the world’s 100 largest companies.

- SASB (Sustainability Accounting Standards Board): Offers industry-specific standards for material sustainability risks with over 616 companies disclosing SASB-aligned metrics by 2020 and fourfold growth in SASB usage since 2020.

- GRI (Global Reporting Initiative): Broad ESG reporting framework adopted by 71% of the largest 5,800 companies worldwide and 77% of the G250 multinationals, supporting detailed environmental, social and governance disclosures.

Linking to Financials

Integrating sustainability metrics into core financial reporting enables boards and investors to see direct performance impacts:

- Investor demand for clarity: Nearly 60% of large investors report that inconsistent ESG ratings hamper decision-making, underscoring the need for standardized disclosures tied to cash-flow impacts.

- Quantifying value: KPMG’s econometric analysis of 2,500 firms across 60 industries found 21 sustainability indicators—such as lower CO₂ emissions—correlate positively with gross profit margins.

- Strategic integration: SAP research highlights that linking sustainability to revenue, efficiency and risk metrics transforms ESG from a compliance exercise into a decision-making tool that guides resource allocation.

Third-Party Verification

Independent assurance of ESG reports bolsters credibility and reduces risk of restatements or litigation:

- Audit-ready disclosures: BDO recommends phased investments in data infrastructure followed by external audits to ensure transparency and completeness of sustainability data.

- Reputational and financial benefits: Baker Tilly reports that companies with third-party ESG assurance often gain stronger ESG ratings, improved stakeholder trust and more favorable financing terms.

- Global assurance practices: Comundo notes that independent verification not only validates environmental data but also signals to customers and investors that reported

Conclusion

A capable Chief Sustainability Officer now occupies a key seat at the leadership table, delivering quantifiable returns through risk management, operational efficiency management, and improved brand credibility. Board-level mandates, clear authority and dedicated resources empower CSOs to integrate ESG objectives into capital planning, executive incentives and cross-functional operations, turning non-financial commitments into strategic drivers. Immediate appointment of CSOs as strategic advisors is imperative, given tightening regulatory requirements and rising investor scrutiny that link sustainability performance with cost of capital and competitive positioning.

Executive search must be ready to support enterprises and growing enterprises secure Chief Sustainability Officers with the technology savviness and board-level gravitas needed to turn sustainability goals into durable value creation.

If you are looking to hire for a CSO or CXO role across manufacturing, retail, oil & gas, energy, IT, Tech, BFSI, etc., our executive search experts can offer the required support. Get in touch.

FAQs

A CSO leads corporate sustainability efforts by setting environmental and social targets, advising on regulatory compliance, and embedding ESG metrics into strategic decisions. They report to the CEO or board committees, coordinate cross-functional teams, and track performance.

Corporate sustainability began with Environmental Compliance Officers in the late 1980s, shifted to CSR management in the mid-2000s, and expanded after the Paris Agreement in 2015. Investor demands and consumer activism then positioned the CSO as a board-level advisor.

They secure executive engagement, guide cross-departmental collaboration, set policy frameworks, and oversee risk management. CSOs chair ESG steering teams, advise compensation committees on sustainability KPIs, and brief boards on climate and social performance.

A strong CSO combines carbon accounting mastery (GHG Protocol, ISO 14064), scope 3 due diligence, scenario modelling, cost–benefit analysis, board-level communication, and stakeholder engagement. Change management expertise and workshop facilitation unite teams around shared goals.

Organizations use either a centralized CSO office with a dedicated budget and staff or embed sustainability champions in key functions like procurement and operations. A dual-model approach balances top-down leadership with grassroots engagement.

Common obstacles include short-term profit pressure, data fragmentation, talent gaps, and shifting regulations. CSOs counter profit bias with scenario planning, invest in phased data infrastructure, develop leadership pipelines, and partner with advisors for real-time regulatory updates.

Performance relies on metrics tied to emission reductions, social impact, and governance outcomes. Companies adopt frameworks like TCFD, SASB, and GRI, integrate sustainability data into financial reports, and seek third-party assurance.

Engage with an executive search partner with ESG expertise, define clear mandates and competencies, and establish development pathways for internal talent. Use fellowships, certifications, and mentoring programs to build candidate pools.

Leave a Reply