Preparing Your Team to Combat Cyber Risks: 7 Tips for Insurance Leaders

Introduction

Cyber risks are no longer limited to IT departments—they are a central challenge for business leaders across industries. For insurance companies, the risks are particularly severe. Managing sensitive client data makes insurers prime targets for cybercriminals, who are continually evolving their tactics. What once were sporadic incidents like ransomware, phishing, and data breaches have now become widespread threats, jeopardizing operational stability, customer trust, and compliance with regulations.

The interconnected nature of modern businesses adds to the complexity. Insurance firms work closely with third-party vendors, technology providers, and other stakeholders, creating an intricate network of potential vulnerabilities. A single weak link can lead to a cascade of consequences, exposing private data and triggering financial, legal, and reputational fallout. Additionally, as insurers embrace digital transformation—adopting AI-powered underwriting, digital platforms, and automated claims processes—their exposure to cyber threats expands.

Recent developments emphasize the need for heightened vigilance. The 2024 Travelers Risk Index by leading US insurance company The Travelers Companies, Inc., identified cyber threats as the top concern for business leaders, with 62% citing it as a major worry. Compounding this, regulators are enforcing stricter penalties for breaches. Geico’s $9.75 million fine after a data breach exposed 116,000 drivers’ personal data underscores the financial and regulatory stakes for the insurance industry.

These incidents highlight a vital truth: a robust cybersecurity strategy is not just a technical safeguard—it’s a business imperative. Insurance leaders can learn from sectors like banking and financial services, which have established sophisticated fraud detection systems and advanced cybersecurity practices. Drawing from these lessons, insurers can build stronger defenses to protect their operations and customers. Below are actionable insights to guide insurance leaders in addressing today’s cyber risks.

What’s at Stake for Insurance Companies?

Financial Consequences

Cyberattacks bring substantial financial costs. IBM’s 2023 Cost of a Data Breach Report estimates the average breach cost at $4.88 million. For insurance companies, these costs are magnified due to the sensitive nature of the data they manage, including personal and health records. Recovery involves not just immediate expenses like forensics and customer notifications but also long-term impacts like increased reinsurance premiums and elevated compliance requirements. Regulatory penalties, such as the one Geico faced, only add to the financial burden.

Reputational Damage

Trust and confidentiality are at the core of the covenant between insurance companies and customers. Clients expect their personal and financial information to be handled with the utmost degree of sensitivity and confidentiality. A breach can erode this trust, leading to client attrition and a damaged brand reputation. Financial institutions that have faced breaches show how loss of trust results in fewer new customers and reduced opportunities for cross-selling. Rebuilding trust can take years and require significant investments in public relations and visible improvements in security measures.

Emerging Threats

- Ransomware Escalation: Modern ransomware attacks go beyond encrypting data; they now include threats of public exposure. According to Sophos’ 2024 Ransomware Report, 76% of victims face extortion schemes involving stolen data. For insurers, the stakes are high, as stolen claims histories and medical records can lead to legal liabilities and loss of customers. To address this, insurance firms can adopt measures like immutable backups and AI-based threat detection systems—practices already proving effective in the banking sector.

- AI-Driven Threats: The rise of AI-powered cyberattacks adds a new layer of risk. Deepfake technology is enabling more convincing phishing schemes and fraudulent claims. Advanced voice or video manipulations can deceive even experienced professionals. Banking institutions have started using AI-driven anomaly detection to identify and mitigate such threats. Insurance firms should consider adopting similar tools to protect against fraudulent activities and enhance operational security.

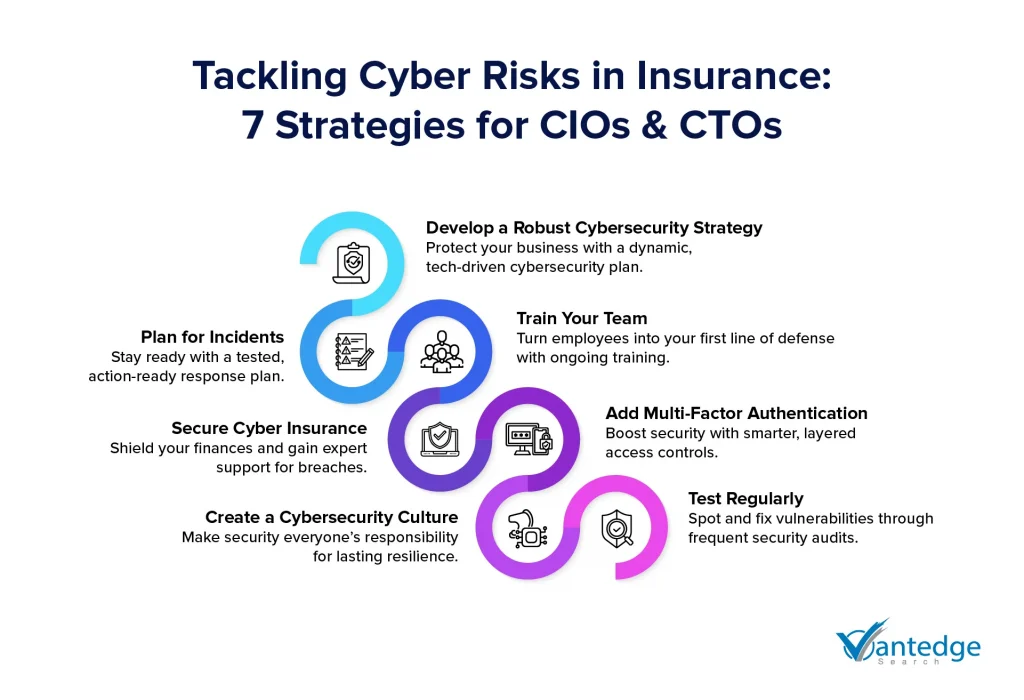

Seven Tips to Prepare Teams for Cyber Risks

Insurance companies handle large volumes of sensitive customer data, making them attractive targets for cybercriminals. To counter evolving cyber threats, insurance leaders need to foster a strategic, team-oriented approach. Drawing on best practices from the insurance sector and lessons from industries like banking and financial services, here are seven actionable tips to strengthen defenses and prepare your teams for cyber risks.

1. Build a Strong Cybersecurity Strategy

What to Do:

Start with a comprehensive strategy that covers risk assessments, preventive measures, and incident response protocols. Ensure the plan adapts to new threats and complies with evolving regulations like GDPR and NYDFS Cybersecurity Regulation.

Learning from Others:

The banking industry employs layered defenses, combining predictive analytics with real-time monitoring to detect and neutralize vulnerabilities early. Adopting a similar approach can help insurers fortify their systems.

Why It Matters:

A unified strategy eliminates confusion, clarifies roles during an incident, and aligns all departments toward a shared goal. Frameworks like ISO 27001 have shown their effectiveness in reducing disruptions and earning customer trust.

Key Takeaway:

Leverage advanced technologies like AI-driven threat detection to enhance your strategy and stay ahead of attackers.

2. Prioritize Employee Training and Awareness

What to Do:

Empower your employees with knowledge. Regular training sessions can help them recognize phishing attempts, avoid social engineering, and securely handle customer data. Simulated attacks are a great way to assess and improve readiness.

Enhance Engagement:

Encourage employees to pursue certifications like CISSP or CISM to deepen their cybersecurity expertise. Partner with experts to deliver training tailored to the unique risks in insurance, such as fraudulent claims or unauthorized access.

Why It Matters:

Deloitte reports that fostering a culture of cybersecurity awareness reduces breach risks linked to human error by 43%.

Key Takeaway:

Take a cue from financial institutions that integrate ongoing learning into their operations to ensure employees remain vigilant.

3. Implement Multi-Factor Authentication (MFA)

Why It’s Critical:

Passwords alone can’t stand up to modern cyberattacks. MFA adds an extra layer of security, requiring users to verify their identity through multiple means like biometrics, hardware tokens, or one-time codes.

How to Start:

Roll out MFA for all critical systems, including claims processing platforms, underwriting tools, and customer data portals. Use adaptive MFA solutions, which adjust security levels based on user behavior—a method already embraced by banks.

Key Takeaway:

MFA not only deters unauthorized access but also reassures regulators, customers, and partners that their data is secure.

4. Conduct Regular Security Assessments

What’s Needed:

Penetration testing, vulnerability scans, and third-party audits are essential to identifying and addressing weaknesses in your cybersecurity framework.

Best Practices:

Banks routinely employ ethical hackers to simulate attacks, identifying vulnerabilities before cybercriminals can exploit them. Insurance firms should adopt similar tactics, especially for systems housing customer data.

Why It Matters:

Regular assessments provide actionable insights to strengthen defenses and reassure stakeholders.

Key Takeaway:

Consistent testing and improvement boost your organization’s resilience and protect its reputation.

5. Develop a Robust Incident Response Plan (IRP)

What It Should Include:

An IRP outlines roles, communication protocols, and actions to contain, investigate, and recover from cyber incidents. Regularly test and refine the plan to ensure readiness.

Example to Follow:

Banks integrate IRPs with business continuity plans and conduct simulations to prepare for scenarios like ransomware or system outages. This approach ensures teams are well-practiced in handling crises.

Why It Matters:

A well-executed IRP minimizes operational disruptions, protects your brand, and ensures compliance with regulatory requirements.

Key Takeaway:

Preparation is the key to managing breaches effectively and limiting their impact.

6. Partner with Cyber Insurance Providers

Why It’s Important:

Cyber insurance helps manage the financial consequences of breaches while providing access to critical resources like forensic experts and breach notification services.

Learn from Financial Services:

Banks use cyber insurance not only to mitigate losses but also to analyze claims data and enhance their own risk management strategies.

Why It Matters:

A partnership with a reliable cyber insurance provider can provide valuable support in navigating complex cyber incidents.

Key Takeaway:

Cyber insurance is both a financial safety net and a strategic tool to strengthen your defenses.

7. Foster a Culture of Cybersecurity

Why It Works:

When cybersecurity is a shared responsibility, it becomes part of the organization’s DNA. This reduces insider threats and ensures collective vigilance.

Practical Steps:

Recognize employees for identifying threats, turn near-misses into learning opportunities, and make cybersecurity awareness part of performance evaluations. The banking industry has shown that fostering a proactive culture improves collaboration and reduces risks.

Key Takeaway:

A strong cybersecurity culture ensures long-term resilience and fosters trust at all levels of the organization.

Ready to transform your leadership landscape

The Importance of Digital Leadership for Insurance Leaders in Fighting Cyber Risks

As cyber risks become increasingly pervasive in the insurance sector, effective digital leadership has shifted from being a competitive advantage to a foundational necessity. For insurance leaders, cybersecurity is no longer a back-office IT function; it’s a strategic business priority intersecting with compliance, customer experience, and operational continuity. Addressing these risks requires a holistic approach that integrates strategic vision, cross-functional collaboration, and cultural transformation, creating a robust framework to safeguard organizational resilience.

Cybersecurity as a Strategic Business Priority

Insurance leaders must reframe cybersecurity as a business enabler rather than a technical expense. The digital age positions insurers not only as financial institutions but as custodians of highly sensitive client data, operating in an ecosystem of heightened regulatory scrutiny and sophisticated cyber threats. Aligning cybersecurity efforts with broader organizational goals—such as maintaining customer trust, driving digital transformation, and ensuring operational continuity—is a hallmark of forward-thinking digital leadership.

This approach is exemplified by Peter Zaffino, CEO of AIG, who has championed the integration of cybersecurity into AIG’s strategic priorities. Under Zaffino’s leadership, AIG has launched an innovation hub to enhance its digital and AI capabilities, laying the groundwork for robust cyber risk management frameworks. By aligning cybersecurity investments with the company’s broader objectives, Zaffino has demonstrated how insurers can position themselves as leaders in operational resilience and digital trust.

Similarly, Thomas Buberl, CEO of AXA, has underscored the critical importance of embedding cybersecurity into the organizational fabric. AXA promotes a company-wide security culture through its “CARE, PROTECT, ALERT” framework, ensuring that all 145,000 employees understand their role in protecting the company and its customers against cyber risks. Under Buberl’s leadership, AXA has also adopted blockchain technology for secure data sharing and invested in cybersecurity startups via AXA Venture Partners. Moreover, AXA Board members are actively engaged in overseeing cyber and technology risks, receiving regular training from the Chief Security Officer and contributing to a governance structure that integrates cyber resilience at every level. These efforts demonstrate how cybersecurity can be both a cultural cornerstone and a strategic advantage.

A strategic view of cybersecurity also recognizes its potential as a competitive differentiator. Companies that demonstrate proactive risk management and digital maturity are better equipped to meet regulatory expectations, win client trust, and outpace competitors who lag in cyber resilience. Leaders like Zaffino and Buberl have shown how to align investments in cybersecurity with long-term strategic objectives, positioning their organizations as benchmarks of security and innovation.

Conclusion

The growing threat of cyber risks in insurance demands a bold shift in leadership, strategy, and culture. For insurance leaders, it’s no longer about reacting to attacks—it’s about anticipating them, embedding resilience, and turning cybersecurity into a competitive advantage.

With sensitive data and customer trust on the line, the stakes couldn’t be higher. However, these challenges also open doors for innovation and differentiation. By leveraging advanced technologies like AI-driven threat detection, fostering cross-functional collaboration, and instilling a culture of cybersecurity, insurance firms can safeguard their operations and redefine their value in the marketplace.

Cybersecurity is not just a technical challenge; it’s a leadership imperative. Those who prioritize strategic foresight and operational excellence will lead their organizations through today’s risks and toward tomorrow’s opportunities.

Is your leadership team equipped to meet the demands of an evolving cyber landscape? Partner with Vantedge Search to find visionary leaders who can navigate complexity and drive resilience. Together, let’s future-proof your organization for continued success.

FAQs

Insurance companies handle large volumes of sensitive data, including personal and health information. This makes them prime targets for cybercriminals. Additionally, the financial and reputational consequences of breaches are significant, potentially leading to regulatory fines, customer loss, and increased operational costs.

Insurance companies can adopt advanced measures like immutable backups and AI-based threat detection systems. Regular employee training on recognizing phishing attempts and enforcing strong multi-factor authentication (MFA) are also effective strategies to reduce the risk of ransomware attacks.

Employees are often the first line of defense against cyber threats. Regular training helps staff identify potential risks, such as phishing scams and social engineering tactics. Simulated cyberattacks and continuous learning programs can significantly lower breach risks caused by human error.

Yes, cyber insurance can help manage the financial impact of a breach and provide access to essential resources like forensic experts and legal support. It’s a valuable risk management tool that complements internal cybersecurity efforts.

An effective IRP should include clear roles and responsibilities, communication protocols, and step-by-step actions for containing, investigating, and recovering from cyber incidents. Regular testing and updates to the plan ensure readiness in the event of a breach.

Leave a Reply