Leading in a New Reality: 6 Insurance Leadership Trends to Watch in 2025

Introduction

As we move towards 2025, the insurance sector is reaching a critical inflection point where leadership, innovation, and strategic foresight will determine the winners and the laggards. The pivotal era is characterized by rapid technological evolution, shifting market dynamics, and an ever-increasing emphasis on sustainability and trust. What implications do these changes hold for insurance leadership?

This blog delves into the emerging leadership trends that are setting the stage for a transformative decade in the insurance industry. We will explore six key trends that promise to redefine how insurance leadership will drive growth, manage risks, and foster trust in an increasingly complex and interconnected world.

Challenges and Opportunities: The Future Landscape of Insurance Leadership

The insurance industry is at a turning point, as highlighted in PwC’s report Insurance 2025 and Beyond. The acceleration of digital transformation is reshaping core operations and customer interactions. Advanced technologies such as artificial intelligence, blockchain, and big data are not merely optional enhancements but essential tools for survival. These technologies enable more precise risk assessments and faster, more personalized customer service. Yet, this shift presents a formidable challenge for traditional insurers burdened with legacy systems that are often cumbersome and resistant to rapid integration, thereby stalling immediate transformation efforts.

Simultaneously, there is a significant evolution in consumer expectations. Today’s customers demand transparency, agility, and customization from their insurance providers. The digital age has empowered consumers with choices and a voice that can amplify dissatisfaction or appreciation globally in seconds. Insurers are thus compelled to reevaluate and enhance their customer engagement strategies to maintain competitiveness. Evolution also extends to the type of products offered, with a growing demand for policies that are flexible and tailored to individual circumstances, further complicating the landscape for insurers.

On the opportunity spectrum, sustainability in insurance represents a transformative frontier for the industry. As environmental, social, and governance (ESG) concerns become increasingly paramount, insurers have the potential to lead the charge in promoting sustainability. By integrating ESG factors into risk management in insurance and investment strategies, insurers can not only mitigate risks more effectively but also attract customers and investors who prioritize corporate responsibility. This shift toward sustainability in insurance is not merely an ethical imperative but a strategic one that can differentiate leading insurers in a crowded market.

Finally, the convergence of insurance with other industries presents both a challenge and an opportunity. Insurers are finding that they can no longer operate in silos but must engage in broader ecosystems that include everything from technology startups to traditional manufacturing companies. This convergence necessitates a rethinking of traditional business models and the forging of strategic partnerships that can offer innovative solutions spanning multiple sectors. Such collaborations can lead to the development of new products and markets, ultimately driving growth in an increasingly interconnected world.

With the insurance industry at such a critical point, it becomes essential to consider the potential leadership trends that could shape its future. The trends we are about to explore offer insights into how visionary leadership might navigate these complex challenges.

Struggling to Find the Right Leader?

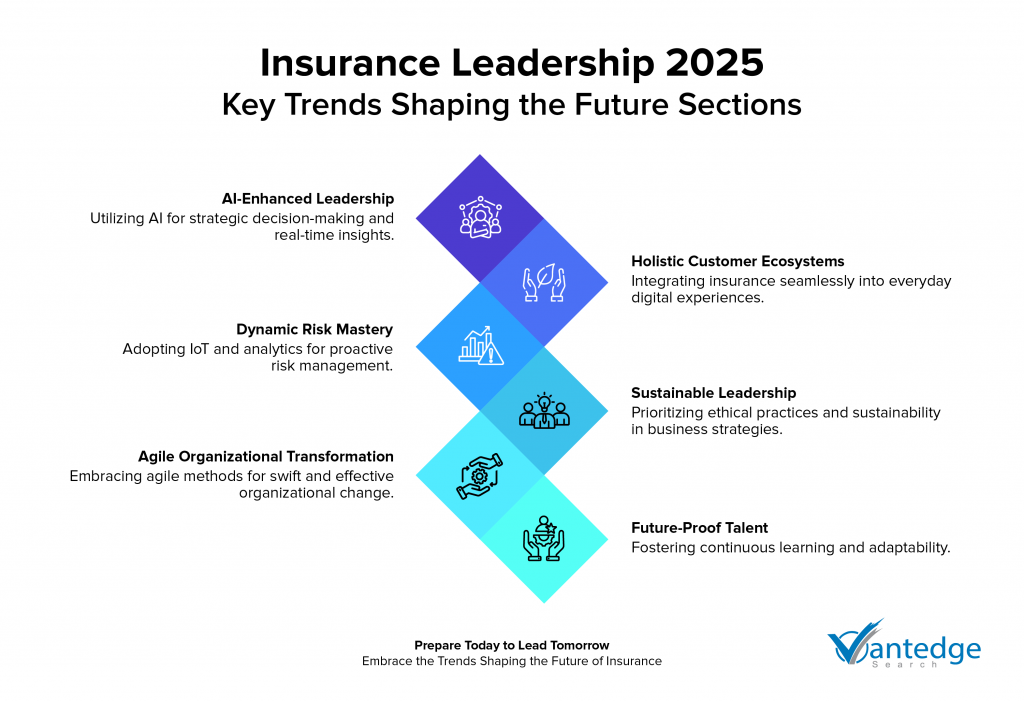

Visionary Leadership in 2025: Key Trends Shaping Insurance Industry Future

As the insurance industry approaches 2025, it faces a transformation influenced by rapid technological advances and changing market dynamics. This section delves into six pivotal insurance industry leadership trends identified through several comprehensive analyses, such as by McKinsey, Accenture, and WNS. These highlight how visionary leadership will navigate through innovations in AI, pursue customer engagement, and undertake proactive risk management in insurance, shaping resilient and forward-thinking insurance strategies.

1. AI-Enhanced Decision-Making: Steering Insurance Leadership Through Complexity

Trend Overview

As we edge closer to 2025, AI’s role in insurance leadership is becoming increasingly crucial. The trend goes beyond adopting new technologies; it fundamentally redefines leadership dynamics, enabling leaders to leverage AI for insightful, data-driven decision-making. The shift would empower leaders with unprecedented analytical capabilities, transforming their approach to opportunities and challenges in insurance.

Strategic Initiatives

1. Expansion of Real-time Decision Support Systems

Building on current technologies, there will be a broader adoption of real-time decision support systems that provide instant analytical insights. Current platforms by companies like Palantir Technologies showcase how complex data can be leveraged to enhance decision-making. By 2025, these systems will be more advanced, integrating deeper learning algorithms and broader data sets to support even more nuanced and strategic leadership decisions.

2. Widespread Use of AI-Powered Simulation for Strategic Planning

The concept of simulating business scenarios, currently exemplified by companies like Simudyne, will become a standard strategic tool in the insurance industry. These simulations will allow leaders to experiment with decisions in a risk-free environment, enabling better preparedness and agility in actual market conditions.

3. Dynamic Policy Adjustment Tools Becoming the Norm

Following the lead of innovative companies like Lemonade, the insurance industry will see a significant shift towards dynamic policy management tools. By 2025, these tools will use AI to automatically adjust policies based on real-time data, behavior patterns, and emerging risks, significantly enhancing responsiveness to client needs and market changes.

AI integration in insurance leadership is about cultivating a forward-thinking mindset that embraces agility and informed decision-making. As AI tools become more embedded in the strategic fabric of the insurance industry, leaders who adeptly harness these capabilities will define the future trajectory of their organizations.

2. Holistic Customer Ecosystems: Undertaking Digital Transformation in Insurance

Trend Overview

By 2025, insurance leadership would prioritize the development of holistic customer ecosystems that integrate insurance seamlessly into the daily lives of consumers. This involves creating interconnected systems through partnerships across various sectors, ensuring that insurance solutions are embedded within everyday activities and touchpoints, enhancing customer experience and engagement.

Strategic Initiatives

1. Integration with Digital Ecosystems

Leading insurance companies will form strategic alliances with tech giants and service providers to embed insurance services into widely used digital platforms. For example, integrating insurance options into e-commerce platforms like Amazon or health apps like Apple Health, similar to how Route integrates shipping insurance into its package-tracking app, will allow customers to purchase and manage insurance seamlessly during routine activities.

2. Re-engineering the Value Chain as a Set of Digital Services

To stay competitive, insurers will transform their traditional value chains into a suite of digital services. This involves automating underwriting, claims processing, and customer service through AI and machine learning, resulting in faster, more efficient operations. By adopting a digital mindset, insurers can disrupt traditional distribution models, offering on-demand insurance products through mobile apps and online platforms, thus reaching a wider audience and improving accessibility.

3. Proactive Regulatory Compliance through Digital Solutions

Regulatory compliance will be further integrated into the digital transformation strategy. Leaders will leverage AI and blockchain technologies to create transparent, automated compliance systems. These systems will continuously monitor and ensure adherence to regulatory standards in real-time, reducing the risk of non-compliance and enhancing trust with regulators and customers. For instance, AI-driven compliance tools can analyze transactions and flag potential issues before they become significant problems, while blockchain can provide immutable records of compliance activities, making audits more efficient and transparent.

4. Development of Multi-Sector Partnerships

Insurers will collaborate with industries such as automotive, healthcare, and smart home technology to create comprehensive insurance packages. For instance, partnerships with car manufacturers could see auto insurance integrated into vehicle purchase and maintenance processes, using data from smart vehicles to adjust premiums in real-time based on driving behavior. This approach, inspired by companies like Tesla Insurance, ensures that insurance is an intrinsic part of the product lifecycle.

5. Personalized Customer Engagement Tools

The deployment of AI-driven customer engagement tools will enable insurers to offer highly personalized insurance products tailored to individual needs and behaviors. Companies like Lemonade already use AI to create customer-centric experiences. By 2025, advanced AI and machine learning will allow insurers to proactively offer customized insurance solutions based on real-time data from wearables, smart devices, and other IoT technologies, enhancing customer satisfaction and loyalty.

The development of holistic customer ecosystems represents a significant paradigm shift in how insurance companies interact with their clients. By embedding insurance even more into the digital and physical spaces that customers inhabit, the insurance leadership would further enhance service delivery, alongside setting new standards for customer engagement. This is likely to boost customer loyalty and strengthen the competitive edge in the market.

3. Proactive Risk Management in Insurance: Agile Strategies for Evolving Threats

Trend Overview

By 2025, dynamic risk assessment and response will have evolved into a highly sophisticated framework powered by AI and IoT advancements. These technologies will enable insurers to not just react to risks, but anticipate them with high accuracy, allowing for preemptive actions that mitigate potential damages before they occur. This foresight will provide significant economic benefits, reducing losses and enhancing efficiency. Furthermore, the ability to dynamically adjust policies in real-time based on evolving data will redefine customer service, offering personalized, timely solutions that meet individual needs. Such proactive measures will set the standard for the industry, ensuring that insurers remain at the forefront of innovation and customer satisfaction in an increasingly uncertain world.

Strategic Leadership Initiatives

1. Cultivating a Culture of Real-Time Risk Monitoring

Leaders will foster a culture where real-time risk monitoring is central to decision-making. Advanced platforms like those from Palantir Technologies will become standard, offering comprehensive insights from diverse data sources. This will enable leaders to swiftly identify and mitigate emerging risks, fostering a proactive and vigilant organizational mindset.

2. Embracing IoT-Driven Risk Data Collection

Leaders will champion the use of IoT devices to collect continuous data on insured assets. This real-time data will inform dynamic risk assessments and policy adjustments. For example, leaders can draw inspiration from John Hancock, which uses wearables to track health data for life insurance policies, rewarding proactive health behaviors. This approach will enhance risk accuracy and customer engagement, positioning the company as a leader in innovative risk management.

3. Leading with Predictive Analytics for Proactive Risk Management

Insurance leaders will leverage predictive analytics to anticipate and manage risks before they occur. Utilizing advanced models like those employed by Swiss Re for disaster prediction, leaders will integrate these tools into their strategic planning. By 2025, predictive analytics will allow for customized risk prevention advice and pre-emptive policy adjustments, showcasing leadership that prioritizes foresight and proactive strategies.

Agility in risk management will distinguish leading insurers from the competition. By integrating IoT and machine learning, insurers can revolutionize their approach to risk, transforming potential vulnerabilities into well-managed assets.

4. ESG-Driven Leadership: Embedding Ethical Practices for Sustainability in Insurance

Trend Overview

By the year 2025, sustainable and ethical leadership will be at the heart of the insurance industry’s operational and strategic ethos. The focus will not only redefine the products and services offered but also how companies interact with communities and the environment. The integration of advanced technologies and ESG principles will enable insurers to predict and mitigate risks with greater precision, while also fostering a corporate culture that values transparency and responsibility. This will enable the insurance leadership to position companies not just as financial institutions but as proactive partners in global sustainability efforts, enhancing their brand value and forging deeper connections with a new generation of consumers who prioritize ethical considerations in their purchasing decisions.

Strategic Leadership Initiatives

1. Embedding Sustainability into Corporate Strategy

Leaders will ensure that sustainability is integral to their corporate and insurance strategies. This involves developing insurance products that promote environmental responsibility and social good. By 2025, more insurers will integrate sustainability goals into their core business models and investment strategies, going beyond commitments like those of AXA. Future initiatives might include comprehensive climate risk assessments embedded into all underwriting processes and widespread adoption of green insurance products that incentivize environmentally friendly behaviors. For example, a module could offer lower premiums to clients with sustainable practices and investments in renewable energy, encouraging both corporate and individual policyholders to adopt greener habits.

2. Promoting Ethical Practices and Transparency

Insurance leadership will champion ethical practices and transparency, fostering trust and accountability. By 2025, this will evolve into a more sophisticated governance framework that includes AI ethics councils and blockchain-based transparency systems to ensure data integrity and customer trust. Companies will leverage advanced technologies to enhance ethical practices, ensuring they remain at the forefront of responsible business conduct. A potential innovation could be a blockchain module that tracks and reports ethical metrics in real-time, ensuring complete transparency in all transactions and decision-making processes, thereby building stronger trust with stakeholders.

3. Engaging with Communities and Stakeholders

Insurance strategies will be designed more to drive initiatives that actively engage with communities and stakeholders to address societal challenges. In 2025, such engagements will be more comprehensive, with insurers partnering with smart city projects to offer community-based risk management solutions. Initiatives like Zurich Insurance’s flood resilience program will expand into broader environmental and social initiatives, leveraging IoT and AI to support community resilience in real-time. For instance, a module could be based on utilizing IoT sensors in high-risk areas to provide real-time alerts and risk assessments, enhancing community safety and preparedness. This proactive approach ensures that insurance companies play a pivotal role in community development and disaster readiness.

Sustainability and ethical leadership will, therefore, transform from emerging trends to foundational pillars within the insurance industry. This paradigm shift will profoundly influence product development, corporate culture, and community engagement, establishing new benchmarks for responsible business conduct.

5. Agile Insurance Transformation: Shaping Responsive Organizational Cultures

Trend Overview

The year 2025 will likely see insurance leaders place a premium on execution, transforming their organizations into outcome-oriented entities. This involves building robust change-management capabilities and establishing dedicated transformation management offices. Leaders will adopt agile delivery models, ensuring swift implementation of strategic initiatives and seamless adaptation to market dynamics.

Strategic Leadership Initiatives

1. Building an Outcome-Oriented Organization

Insurance leadership will focus on creating an outcome-oriented culture, where every strategic initiative is driven by clear, measurable goals. This involves integrating performance metrics across all levels of the organization and fostering accountability. Leaders will prioritize projects that deliver tangible results, ensuring that resources are allocated efficiently and that every team member understands their role in achieving organizational objectives.

2. Enhancing Change Management and Agile Delivery

To navigate the rapidly evolving landscape, leaders will build strong change-management capabilities, preparing their organizations to handle continuous transformation. Establishing a transformation management office will centralize efforts, ensuring coherence and alignment across all initiatives. Adopting an agile delivery model will further enhance the organization’s ability to implement changes swiftly and effectively, promoting a culture of continuous improvement and innovation. This agile approach will enable insurance companies to stay ahead of market trends and regulatory changes, ensuring long-term success.

Agile organizational transformation will set a new standard for operational excellence. The shift to outcome-oriented and agile methodologies will streamline processes, empowering organizations to rapidly adapt to market changes and emerging opportunities. As a result, insurers will be better positioned to respond to customer needs and regulatory demands with unprecedented speed and efficiency. The proactive and dynamic approach will ensure long-term sustainability and competitive advantage, establishing agile leaders as pioneers in an evolving landscape.

6. Future-Proof Talent: Equipping Insurance Team for Tomorrow’s Challenges

Trend Overview

By 2025, insurance leadership will be at the forefront of equipping their workforce for a digital, ESG-focused, and customer-centric landscape.

Strategic Leadership Initiatives

1. Advanced Skills Training and Continuous Learning

Insurance strategies will leverage sophisticated AI-driven platforms to deliver personalized learning experiences tailored to the needs of the insurance industry. These platforms will offer scenario-based training and simulations to prepare employees for real-world challenges, focusing on digital skills, customer engagement techniques, and ESG compliance. The training will emphasize practical applications and real-time feedback, ensuring skills are immediately applicable.

2. Integration of ESG Principles

By 2025, embedding ESG principles into every facet of business operations will become a priority in insurance strategies. Leaders will initiate comprehensive training programs that focus on environmental stewardship, social responsibility, and corporate governance. These programs will not only cover theoretical aspects but also practical implementations, such as conducting ESG audits, managing sustainable investments, and engaging in community-driven initiatives. The goal is to create a workforce that is not only aware of ESG standards but also actively contributes to sustainability goals.

3. Enhancing Regulatory Compliance Training

As the regulatory landscape evolves, leaders will need to ensure that their teams are well-versed in compliance and governance. Training modules will be updated in real-time as new regulations come into effect, using adaptive learning systems that track changes and update content dynamically. This will ensure that all employees are consistently compliant and understand the implications of regulatory shifts on their roles and the wider industry.

Leadership in the insurance industry will have significantly advanced their approach to talent development, shifting from traditional training models to a dynamic, continuous learning framework that is deeply integrated with everyday work. Leaders will champion initiatives that not only equip employees with current competencies but also instill a mindset geared towards ongoing adaptation and growth.

Simultaneously, the robust commitment to talent development will influence the very nature of leadership itself within the industry. As executives prioritize and model continuous learning and adaptability, they will cultivate leadership qualities that are highly responsive to change and innovation. The transformation will see leadership development itself, becoming more agile, inclusive, and aligned with future strategic directions.

Conclusion

As we move forward, the converging forces of technology, ethics, and customer-centricity are set to redefine leadership dynamics as part of the insurance industry’s future. The perception of insurance will progressively transform from managing risks to creating value in every interaction, decision, and innovation. Tomorrow’s leaders will ensure that organizations are not merely responding to changes, but actively creating these.

Ready to lead in 2025? Connect with us to acquire top talent today and master leadership in insurance.

Leave a Reply